Is Palantir a Buy, Sell, or Hold After Its Most Recent Earnings Report?

Key Points

Palantir topped $1 billion in quarterly revenue for the first time.

Considering the company's extreme valuation, it may be tempting to take profits.

Palantir Technologies (NASDAQ: PLTR) just keeps steaming along. The company had another great earnings report for the third quarter, sending the stock higher again. The year's best-performing stock in the S&P 500 is up 128% just this year, and by an incredible 600% in the last 12 months.

Before Palantir's earnings, I noted three of the most important metrics that investors should consider when evaluating the results -- revenue growth, customer growth and the company's backlog. In all three cases, Palantir managed to exceed expectations, which is why the stock is setting new all-time highs.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Now that the dust has settled, it's time to take a fresh look at Palantir in the wake of its earnings report. Should investors still be bullish, or is it time to start taking profits? Or perhaps investors would do well to sit back and wait.

Here's a peek behind the curtain of Palantir stock.

Palantir's earnings dominance

Palantir operates dominant artificial intelligence (AI) platforms that specialize in pulling information from multiple sources to allow users to make real-time decisions. Its Gotham platform is used by governments and militaries to tap into satellites and scour other sources of information to help commanders position their troops and achieve objectives.

The company's work came to light when it was credited for helping the U.S. military track down 9/11 mastermind Osama bin Laden. Under the Trump administration, it's greatly expanding its work to include Homeland Security, the State Department, the Federal Aviation Administration, and the Centers for Disease Control and Prevention.

Meanwhile, Palantir's Foundry platform is used by commercial customers to help manage a range of activities from hospital records to supply chains and reduce manufacturing costs. Both platforms operate in coordination with Palantir's Artificial Intelligence Platform (AIP), which allows users to type in detailed prompts to get recommendations and insights that are delivered through generative AI. When Palantir unveiled its AIP more than a year ago, its stock really took off.

The momentum continued in the second quarter, when Palantir's quarterly revenue topped the $1 billion mark for the first time, up 48% from a year ago. Income was $269.3 million, up 27% from last year. Breaking it down further, Palantir saw U.S. commercial revenue jump 93% to reach $306 million and U.S. government revenue rise 53% to $426 million.

The company's customer count also jumped, rising 43% from a year ago and 10% from the first quarter. Palantir closed 157 deals in the quarter valued at at least $1 million, and 42 that were valued at at least $10 million.

In addition, Palantir has a long runway of additional growth. The company says it has $2.42 billion in total remaining performance obligations, up from $1.37 billion in the second quarter of last year and up from $1.9 billion in the first quarter. When I analyzed Palantir before its most recent earnings report, I said I would consider anything over $2.15 billion to be a strong number -- and Palantir blew that out of the water.

So where do we go from here -- buy, sell, or hold?

Image source: Getty Images.

The argument to buy

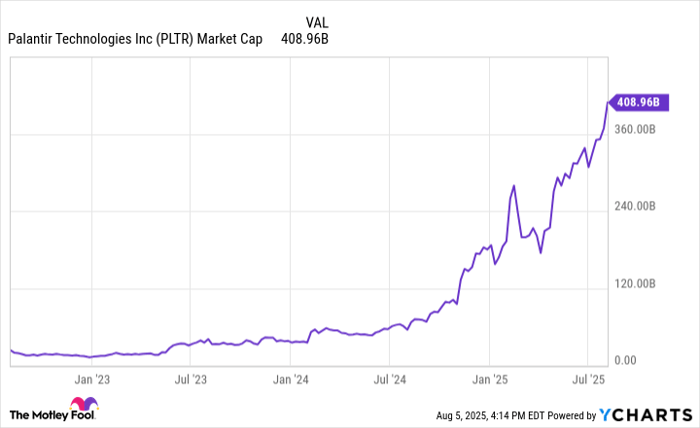

Simply put, Palantir is a world-changing company that has exploded to become one of the most consequential of our time. With a market cap of more than $400 billion now, Palantir is bigger than Home Depot and Procter & Gamble. At the time of this writing, it ranks as No. 23 in the world in size.

With the U.S. government eager to expand Palantir's role and dozens of commercial clients lining up to take advantage of the company's unique abilities, I'm firmly convinced that it's just getting started. CEO Alex Karp has the same vision.

In his most recent letter to shareholders, he boldly states: "With continued execution, and a focus on what matters and a near complete disinterest in what does not, we believe that Palantir will become the dominant software company of the future. And the market is now waking up to this reality."

The argument to sell

I'm a Palantir bull but recognize that the valuation of this stock is out of control. For instance, the company has a price-to-earnings ratio (P/E) of 777 and a forward price-to earnings ratio of 307. That's more than a nosebleed level that's overly inflated because Palantir is reinvesting a lot of its profits. But it would also be ridiculous for anyone to assume that the company will keep that same rate of growth.

Instead of P/E, let's use the price-to-sales ratio (P/S) to forecast reasonable growth. Assume that Palantir generates 40% revenue growth in the next year -- a number that would actually be slowing from its current pace. With that growth, it would have annual revenue of roughly $4.4 billion. As the company has a forward price-to-sales valuation of 108, this would give it a projected market cap in a year of $471 billion -- which would give it roughly the same market cap as Netflix.

That's fine growth, but the market isn't going to keep paying this multiple if the market cap upside is only 18% in the next year -- especially when you consider how dynamic its growth has been so far.

PLTR Market Cap data by YCharts.

Either the valuation begins to return to Earth or the stock remains overly inflated. But I can't think of a reasonable argument based on math instead of momentum for Palantir to sustain its current valuation. With the stock price up 600% in the last 12 months, I couldn't blame anyone for a little profit-taking here.

The argument to hold

This is a simple play -- sit back and wait for more information. If you're not day trading, then it's often wrong to overreact to the news of the day because timing the market is virtually impossible. You'll tend to lose out on opportunities and rack up way too many fees by buying and selling too much. As long as you're confident in the quality of the company, there's nothing wrong with emulating the master of buy-and-hold investing, Warren Buffett.

The final call

While the momentum is all for buying Palantir and the math says to sell, I'm bridging the middle and holding. I think that the opportunity surrounding Palantir is too valuable to discard, but I'm not eager to buy more of the stock at this valuation.

I think that's the right play -- particularly if you have Palantir as part of a well-balanced portfolio. However, if the company is one of a few holdings or it makes up an overly large percentage of your overall holdings, then this is the ideal time to rebalance and reduce your overall exposure.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 1,026%* — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Patrick Sanders has positions in Palantir Technologies. The Motley Fool has positions in and recommends Home Depot, Netflix, and Palantir Technologies. The Motley Fool has a disclosure policy.