Key Points

Home Depot is a blue chip dividend stock long-term investors can count on.

Nucor, UnitedHealth, and Alphabet have become too cheap to ignore.

Criteo is a hidden-gem growth stock packed with upside potential.

The second half of the year is a great time for folks to review what companies they are invested in, why they are invested in them, and to update their watch lists with exciting stocks to buy.

However, some investors may be hesitant to put new capital to work in the market given the rapid recovery over the last few months. The S&P 500 is up more than 20% from its April lows, putting pressure on companies to deliver on expectations.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

When valuations are high, it's even more important that investors focus on quality companies that have what it takes to deliver strong returns without everything having to go right.

Here's why these Fool.com contributors believe that Home Depot (NYSE: HD), Nucor (NYSE: NUE), UnitedHealth Group (NYSE: UNH), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Criteo (NASDAQ: CRTO) stand out as top stocks to buy in July.

Image source: Getty Images.

Spring for this retailer's cheap stock

Demitri Kalogeropoulos (Home Depot): Home Depot stock has become cheaper relative to the market over the past year, and that fact should have investors feeling excited about adding the retailer to their portfolios. Sure, the home improvement giant's business hasn't been performing as well as it did through the pandemic and its immediate aftermath. Comparable-store sales (comps) in the most recent quarter were essentially flat due to a sluggish housing market. Consumers are trading down to less ambitious home improvement projects, too.

Yet customer traffic through early May was positive, rising 2% to help overall revenue improve by 9%. Those figures bode well for the chain's crucial spring selling season, when homeowners tend to spend aggressively on outdoor projects.

"We feel great about our store readiness and product assortment as spring continues to break across the country," CEO Ted Decker told investors in late May. Executives at the time affirmed their fiscal year outlook that calls for comps growth of about 1%, combined with a drop in profit margin to 13% of sales.

That decline would still keep Home Depot ahead of rival Lowe's on profitability. And cash flow remains strong enough for the chain to continue repurchasing shares and paying a robust dividend while investing in the business. The dividend yield is at 2.4%, compared to Lowe's 2%, giving investors another reason to prefer the market leader in this niche.

It could be some time before Home Depot's sales gains accelerate to above 5% again, while operating margin returns to its prior level of just over 14%. But patient investors can hold this sturdy stock while waiting for that rebound, collecting those generous dividend checks along the way.

A turnaround story in the making?

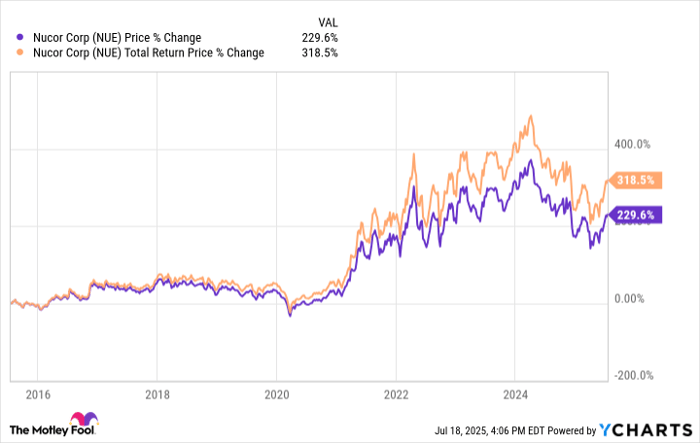

Neha Chamaria (Nucor): After I recommended Nucor in February, the stock sank to a 52-week low in April but has bounced back dramatically -- almost 33% since. Although I am a long-term investor and do not track price movements in the short term, there's a reason I brought this up here. The thesis that I saw earlier this year is playing out for Nucor, meaning the time is ripe to buy the stock if you still haven't.

President Donald Trump imposed a 50% tariff on steel and aluminum imports on June 3, up from 25% he had proposed earlier, to curb the dumping of low-cost steel by other countries and boost the domestic steel industry. Nucor CEO Leon Topalian has publicly supported Trump's tariff policies and believes some, like steel tariffs, were long overdue. Soon after the tariff announcement, his company raised the prices of hot-rolled steel coils and issued encouraging guidance for its second quarter.

After muted first-quarter numbers, the company expects second-quarter earnings to rise considerably across all its segments: steel mills, steel products, and raw materials. Steel mills, also Nucor's largest segment, are expected to report the largest growth in earnings, driven by higher average selling prices.

Overall, the company expects to report earnings between $2.55 and $2.65 per share for the second quarter versus only $0.67 in the previous quarter. Although its second-quarter earnings could still be around 5% lower year over year, this could just be the beginning of an upward earnings and sales trend.

Shares have hugely underperformed the S&P 500 over the past year or so because of declining sales and profits. With demand and prices both picking up, this could be an inflection point for Nucor stock, making it a solid long-term buy at current prices.

A blue chip stock that's a bad-news buy

Keith Speights (UnitedHealth Group): Timing the market is next to impossible. But timing can sometimes be important when buying specific stocks. I don't think there has been a better time to invest in UnitedHealth Group in years.

To be sure, this healthcare stock faces numerous problems. UnitedHealth's Medicare Advantage costs have gotten so out of hand that the company was forced to first cut its full-year 2025 guidance and then later suspend the guidance altogether. This issue seems to have played a big role in the unexpected departure of former CEO Andrew Witty.

The Wall Street Journal's article about a Justice Department (DOJ) investigation into alleged criminal fraud by the company made matters worse. To add to the healthcare giant's misery, President Trump threatened to eliminate pharmacy benefits managers (PBMs). UnitedHealth's Optum Rx ranks as the nation's third-largest PBM.

Why buy UnitedHealth Group stock amid all of this doom and gloom? Its business prospects are significantly better than its valuation reflects. After plunging more than 50%, shares trade at only 13.3 times forward earnings. But most of the headwinds the company faces should eventually wane.

For example, management expects to return to growth next year. I think that makes sense. The solution to higher-than-anticipated Medicare Advantage costs is to boost premiums. While the company has to wait to implement its higher premiums, you can bet they're coming.

Witty was replaced by former longtime CEO Stephen Hemsley, and the company should again be in good shape under his leadership. I suspect Hemsley will direct the company to issue new full-year guidance as soon as possible, which should bolster investors' confidence.

What about the DOJ investigation? It hasn't been confirmed yet. And President Trump's threats to cut out the PBM middleman? That's much easier said than done.

The bottom line is that I believe UnitedHealth Group stock is way oversold right now. This blue chip is a great bad-news buy in July.

A standout in the "Magnificent Seven"

Daniel Foelber (Alphabet): Google parent Alphabet rebounded in lockstep with the broader market last week. But it's still a compelling buy in July.

As many megacap growth stocks have compounded in value, some investors are questioning whether there's still room for these stocks to run or if valuations could limit returns. Alphabet doesn't have that problem.

The stock is so attractively priced that it is cheaper than the S&P 500 on a forward price-to-earnings basis. Whereas the rest of the "Magnificent Seven" are more expensive than the S&P 500 based on this key metric. Meaning that investors don't have the same lofty earnings expectations for Alphabet as they do for companies like Nvidia, Microsoft, or even Apple (even though Apple is growing slower than Alphabet).

To be fair, getting too bogged down by valuations has been a historically bad idea for many of today's top companies. Measuring Microsoft for its legacy software suite alone would have drastically undervalued its now huge cloud computing segment.

Amazon used to be an online bookstore turned e-commerce giant. Similarly, its cloud computing segment, Amazon Web Services, is arguably more valuable than the rest of the company combined. Nvidia used to make most of its money from selling graphics processing units (GPUs) and other solutions for gaming and visualization customers. But today, GPU demand for data centers is the company's bread and butter.

Since no one has a crystal ball, investors have to make calculated bets based on where they think a company could be headed. Looking at Alphabet, I think the company has fairly low risk for its upside potential. Part of that reasoning is that its existing assets are drastically undervalued, and investors aren't giving the company much credit for the upside potential of self-driving through Waymo, the company's quantum computing investments, or its artificial intelligence tool Gemini.

Add it all up, and Alphabet stands out as an effective way to get exposure to many different end markets at a good value.

This ad-tech expert's stock is way too cheap in July

Anders Bylund (Criteo): Sometimes I wonder what it takes to impress Wall Street's market makers. Digital advertising expert Criteo has consistently stumped analysts since the spring of 2023, but the stock is down by 39% in 2025 at the time of this writing.

I get where the market skepticism is coming from. Criteo's top-line sales have been rather slow in recent quarters. The macroeconomic backdrop isn't ideal for big-ticket marketing campaigns, since consumers are holding on to their money with an iron grip.

But the company has tightened up its operations in this uncertain economy. In May's first-quarter report, adjusted earnings rose 38% year over year while free cash flow soared from breakeven to $45 million. For a sense of scale, that's 10% of its revenue in the same quarter.

So Criteo is a cash machine when it counts, and the lessons learned in these hard times should result in solid profit gains when the economy turns sweeter.

Meanwhile, the stock is priced for absolute disaster. Shares are changing hands at 9.8 times earnings and 5.7 times free cash flow, as if the company were losing money by the truckload. The stock price is entirely inappropriate for a very profitable specialist in a temporarily downtrodden industry.

I'm tempted to double down on my Criteo holdings in July, and I highly recommend that you consider this overlooked stock while it's cheap.

Should you invest $1,000 in Home Depot right now?

Before you buy stock in Home Depot, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Home Depot wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $697,627!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $939,655!*

Now, it’s worth noting Stock Advisor’s total average return is 1,045% — a market-crushing outperformance compared to 178% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of June 30, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Anders Bylund has positions in Alphabet, Amazon, Criteo, Nvidia, and UnitedHealth Group. Daniel Foelber has positions in Nvidia. Demitri Kalogeropoulos has positions in Amazon, Apple, and Home Depot. Keith Speights has positions in Alphabet, Amazon, Apple, Lowe's Companies, and Microsoft. Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Home Depot, Microsoft, and Nvidia. The Motley Fool recommends Criteo, Lowe's Companies, and UnitedHealth Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.