The Median Retirement Savings for American Households Is $87,000. Here Are 3 Incredible Stocks to Buy Now and Hold for Decades.

Key Points

Artificial intelligence-powered drug development isn't a mere premise anymore. Recursion Pharmaceuticals has made it a reality.

The next era of e-commerce favors platforms like Shopify's, which allows brands to connect with consumers outside of massive digital shopping malls.

U.S. drivers may not be big fans of electric vehicles, but that's not the case everywhere else.

Are Americans saving enough money to fund a comfortable retirement? Probably not. As the Motley Fool's own research indicates, as of 2022 the median retirement savings for U.S. households is a mere $87,000. That means half of the country has saved up more, while the other half has saved less. Even being in the upper half of the crowd, however, isn't necessarily enough.

Committing more of your income to the effort is still only half the battle though. You'll also need to get more out of your money while you're growing your nest egg. This means achieving bigger gains without taking on significantly more risk.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here's a closer look at three growth stocks you could buy and hold for decades as a means of supercharging your portfolio's growth. While each of these tickers brings some added risk and volatility to the table that will require regular monitoring, their long-term upside potential is arguably worth the work.

Recursion Pharmaceuticals

While artificial intelligence (AI) still has of room for improvement, the writing is on the wall -- the technology will be tackling complex problems that individuals and institutions just can't. This includes designing and testing pharmaceuticals.

Well, the future is here. Recursion Pharmaceuticals (NASDAQ: RXRX) has built an AI-powered platform capable of virtually testing a drug rather than requiring a full-blown clinical trial of an idea. Leveraging 36 petabytes (36 million gigabytes) of digital biological and chemical data, its so-called Recursion OS can accomplish what would normally take years and millions of dollars in a matter of days at a fraction of the cost.

And it's no mere theory. The technology is not only functioning -- it's commercialized. A handful of pharma companies including Roche and Sanofi are using Recursion OS to tackle some of their own developmental work, while Recursion is working on some drugs of its own. All of these drug candidates will still need to go through the actual clinical trial process to satisfy regulatory agencies like the FDA. Recursion's software facilitates focus though, by virtue of weeding out less promising drug prospects so more resources can be devoted to more promising ones. That's huge.

It's still relatively early for Recursion, and for that matter, the AI-assisted drug-development industry itself. Recursion Pharmaceuticals remains in the red, and will likely remain there for at least a few more years. This arguably makes Recursion the riskiest of the three stocks being put under the microscope here.

Just understand the potential reward is commensurate with the risk. Recursion Pharmaceuticals is nearing a revenue and profit turning point in front of what Straits Research believes will be average annualized growth of nearly 32% for the artificial intelligence drug-development industry through 2030. This tailwind alone should be enough to push Recursion to profitability. That makes this stock's prolonged and persistent weakness since peaking in 2021 is a fantastic buying opportunity.

Shopify

Amazon (NASDAQ: AMZN) is in no immediate danger of being dethroned as the king of North America's e-commerce scene. But it's no longer able to simply bully the rest of the industry. Competitors are successfully pushing back... just not in the way you might have expected. Rather than one or two rival names making inroads, brands and merchants are taking matters into their own hands by setting up their own online stores as a means of working all the way around Amazon's domination.

And they've largely got Shopify (NASDAQ: SHOP) to thank for the option.

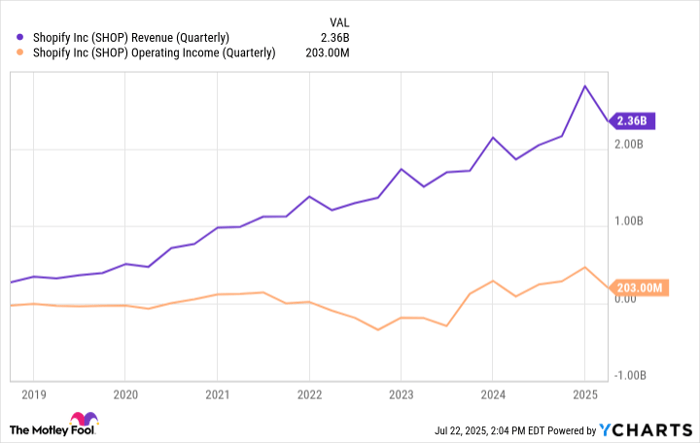

In simplest terms, Shopify helps companies establish their own in-house e-commerce presence. From websites to payment-processing to inventory-management to marketing, Shopify can do it all, making it easy for businesses of all sizes to stay focused on more important matters (like running that business). Although the company no longer discloses how many clients are using its technology, it does divulge the scope of its business. Last year, Shopify's solutions facilitated the sale of $292.3 billion worth of goods and services, up 24% year over year to extend a long-established growth streak. Shopify collected $8.9 billion worth of revenue for itself in the process, turning a little over $1 billion of it into net income.

SHOP Revenue (Quarterly) data by YCharts

This growth still only scratches the surface of the opportunity though. Market research outfit eMarketer reports that only a little more than one-fifth of the world's retail spending is currently done online. The rest is still taking place in brick-and-mortar stores.

While certainly some of these sales will never move online, much of it can. Brand-owned and merchant-managed online stores are positioned to capture more than their fair share of whatever growth awaits the e-commerce industry, however, as these players increasingly see the value in establishing their own direct relationships with customers. In this vein, analysts expect Shopify to produce top-line growth in the ballpark of 20% in each of the three years ahead.

Nio

Finally, add Nio (NYSE: NIO) to your list of stocks to buy and hold for decades if you want a shot at building a bigger retirement nest egg.

It wouldn't be surprising if you'd never heard of it. Although it's finding a bit of traction in Europe, the Chinese maker of electric vehicles predominantly serves China itself. It delivered 72,056 electrified cars during the second quarter of this year, up nearly 26% from the year-ago comparison, underscoring production growth that's been in place for some time now.

Think the electric vehicle (EV) market is hitting a wall due to disinterest? Not so fast. That's largely an American phenomenon. Data gathered by CleanTechnica indicates sales of electric vehicles in China soared 25% to 1.1 million units last month, accounting for more than half of the country's entire automobile sales.

Image source: Getty Images.

That's still just the beginning though. The International Energy Agency expected EVs to account for 80% of China's total car sales by 2030, thanks to supportive policies that encourage the alternative to combustion-powered vehicles. It's making inroads in Europe as well, for the same reason. And, while there's little incentive for the company to make a push into the United States' anemic EV market right now, if and when domestic interest perks up, Nio has maintained tentative plans for that possibility.

It could be a while before Nio works its way out of the red and into the black -- it simply needs more scale. This could make the stock a little less than completely comfortable to own in the interim.

It's making clear progress on the production as well as the profitability front though, and will almost certainly get there sooner or later, and likely sooner. Given how inevitable this outcome now seems, the market's apt to reward the progress en route to fiscal viability.

Should you invest $1,000 in Shopify right now?

Before you buy stock in Shopify, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shopify wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Shopify. The Motley Fool recommends Roche Holding AG. The Motley Fool has a disclosure policy.