Prediction: 2 Stocks That Will Be Worth More Than Tesla 3 Years From Now

Key Points

Sluggish electric vehicle sales threaten the trillion-dollar valuation Tesla generated on enthusiasm for its Robotaxi and Robotics potential.

Toyota could overtake Tesla if the market starts to value Tesla more like an automotive manufacturer than a technology company.

Meanwhile, Alphabet is arguably the autonomous driving leader at this point, and may outperform Tesla stock moving forward.

Tesla (NASDAQ: TSLA) is one of the world's largest companies by market value, worth a little over $1 trillion today. The company is a pioneer in electric vehicles, autonomous driving software, and renewable energy, and is charging full steam into Robotaxis and humanoid robotics.

At face value, there is a lot to like about this technology company. But when you dig deeper, Tesla is far riskier as an investment, given its past success and massive valuation.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Sure, Tesla has a high ceiling, but it also has a very low floor. That's why I predict that Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Toyota Motor (NYSE: TM) will both be worth more than Tesla three years from now.

It's not as far-fetched as it sounds. Here is what you need to know.

The hand of a Tesla Optimus robot. Image source: Tesla.

Tesla's ambitious plans will likely take time, and that could spell near-term trouble

The narrative around Tesla is shifting from its legacy electric vehicle business to Robotaxi and humanoid robotics, which CEO Elon Musk and an increasing number of investors expect to carry the company's value moving forward.

Tesla's electric vehicle sales have started to decline, which could be at least partially due to Elon Musk's sometimes controversial, politicized persona. The issue here is that Tesla has only just begun launching its Robotaxi business, which is limited to a small number of vehicles with multiple safety measures in place. Tesla wants to expand its fleet rapidly, but that may take longer than most want to believe due to local and state-level regulations. Remember, Tesla's self-driving technology has still only obtained Level 2 capability, which mandates a human driver be present in the vehicle while it is autonomously operating.

Optimus, Tesla's humanoid robot, is also still in early stages. While the company aims to build 5,000 Optimus units this year, reports indicate that Tesla is behind on that. Perhaps Optimus will someday generate the trillions of dollars in revenue Elon Musk believes it can, but Tesla has infamously established numerous timetables before that have failed to execute as promised.

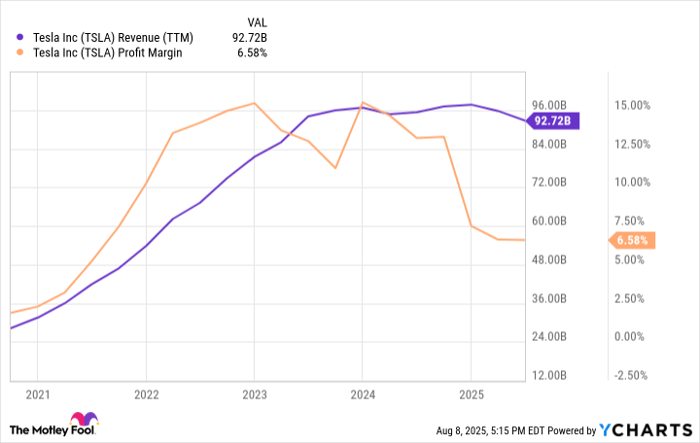

Unless Tesla can ramp Robotaxi and Optimus very quickly over the next year or so, the company's recent sales struggles could weigh significantly on the stock:

Data by YCharts.

Over the past few years, revenue growth ceased and then turned negative. Profit margins have cratered. If investors make Tesla a "prove it" story, the stock, trading at over 12 times revenue, could reasonably see at least 50% downside as its valuation shifts to more closely resemble that of an automotive manufacturer than a technology company.

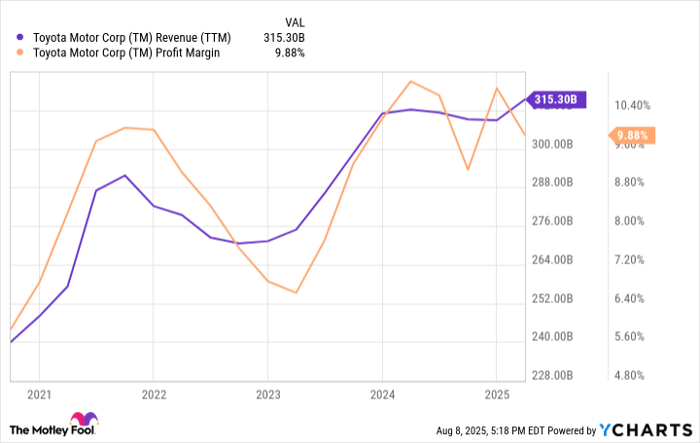

Investors may not appreciate Toyota enough

Take Toyota, for example, which is the world's most valuable legacy automotive company. Its revenue continues to grow to new highs, and its profit margin is far higher, clearing Tesla by over 3 percentage points. Ironically, Toyota has a market cap of just $246 billion, valuing the stock at a price-to-sales (P/S) ratio of less than 1.0, and a fraction of Tesla's.

Data by YCharts.

To be fair to Tesla, I don't think it's likely that the stock's valuation drops all the way down to Toyota's level. The upside is too high if it delivers on Robotaxi and Optimus as investors hope -- even if it takes longer than expected.

But Toyota could surpass Tesla's value if the two meet somewhere in the middle. Using each's trailing-12-month revenue, Toyota's valuation would overtake Tesla's at a P/S ratio of 1, if Tesla's fell to about 3. This comparison is more about Tesla's downside than Toyota's upside, but it highlights Tesla's potential risks if the company doesn't follow through on some very ambitious goals.

Alphabet is the true market leader in self-driving vehicles

It seems safe to say that Waymo is currently the leading autonomous ride-hailing company. That puts parent company Alphabet in the driver's seat.

Alphabet, valued at over $2.3 trillion, is already worth more than Tesla, but some may not feel it will remain that way. Ark Invest's Cathie Wood believes that Tesla's value will skyrocket on Robotaxi growth. But I'm skeptical, at least of such a short time frame, for the reasons I walked through above. Additionally, Alphabet is a central player in artificial intelligence, with a blossoming cloud-computing business and digital advertising business that generates cash flow.

Some might not associate Alphabet with self-driving vehicles. Yet Alphabet is arguably the perfect company to go after that market because it has such strong existing businesses that can fund the investments to develop a self-driving fleet and expand it across the United States. Waymo continues to announce new markets, and until Tesla and Robotaxi close the gap, it's hard not to like Alphabet's prospects better than Tesla's moving forward.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $473,820!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,540!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $653,427!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 11, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Tesla. The Motley Fool has a disclosure policy.