Gen V season 2: your ultimate guide to the highly anticipated Prime Video show's return (release date, trailer, cast, plot)

© Amazon MGM Studios

© Amazon MGM Studios

© Apple TV+

© Photo by Alessio Morgese / Gabriele Lanzo/NurPhoto via Getty Images

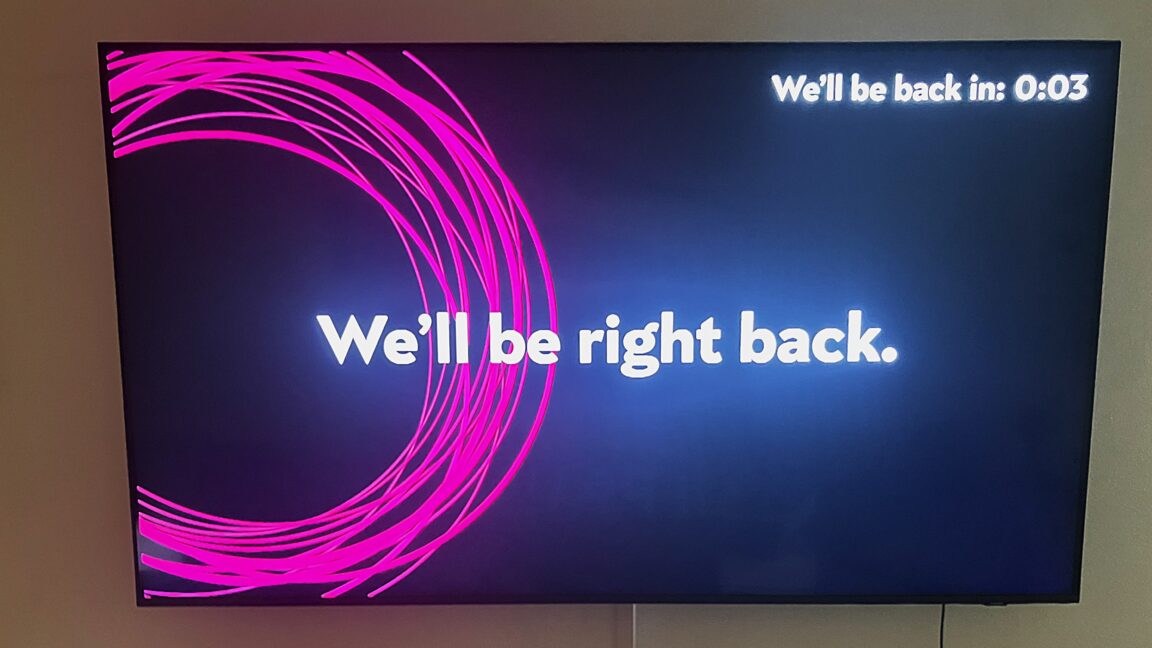

DENVER—Ads shown while you're streaming shows or movies are disruptive enough. But there's something uniquely eerie about what you see when a connected TV (CTV) platform fails to sell ad inventory. You may get a black screen accompanied by ethereal music or a confusing thumping beat, alongside a graphic that says something like, "We'll be right back."

Not only are streamers being forced to endure more ad time than ever, but that time doesn't even always benefit streaming platforms or advertisers. For the past six months, AdGood has been working to turn that blank, wasted ad space into messaging for good by helping nonprofits buy ad space for cheap.

During the StreamTV Show in Denver this week, Ars spoke with Kris Johns, CEO and founder of AdGood, a 501(c)(3) nonprofit that sells unused, CTV ad space to other nonprofits. AdGood sells unfilled, sometimes donated, ad space at discounted rates, which it says can be as low as about $5 to $6 CPMs (cost per mille, or the amount an advertiser pays for every 1,000 impressions an ad earns). Johns said that CTV CPMs can vary depending on the scenario, with costs ranging from $12 to $15 and higher. Some CTV ad firms peg the average CTV CPM at $35 to $65.

© Scharon Harding

Amazon forced all Prime Video subscribers onto a new ad-based subscription tier in January 2024 unless users paid more for their subscription type. Now, the tech giant is reportedly showing twice as many ads to subscribers as it did when it started selling ad-based streaming subscriptions.

Currently, anyone who signs up for Amazon Prime (which is $15 per month or $139 per year) gets Prime Video with ads. If they don’t want to see commercials, they have to pay an extra $3 per month. One can also subscribe to Prime Video alone for $9 per month with ads or $12 per month without ads.

When Amazon originally announced the ad tier, it said it would deliver “meaningfully fewer ads than linear TV and other streaming TV providers." Based on “six ad buyers and documents” ad trade publication AdWeek reported viewing, Amazon has determined the average is four to six minutes of advertisements per hour.

© Panagiotis Pantazidis/Amazon Studios

© Disney Plus

© Lionsgate

© Focus Features

Kevin Dietsch/Getty Images

No one wants to own cable networks anymore.

Would you like to buy some?

That is the pitch that Warner Bros. Discovery is making to Wall Street now that it has announced it's splitting itself into two companies: One will own Warners' movie and television studio and the HBO Max streaming service; the other — which it's calling its "global networks" unit — will own a bunch of cable TV networks including CNN, TNT, Discovery and the Food Network.

If that sounds familiar, it's for two reasons:

WBD has been contemplating this for a long time.

Last summer, it floated the same idea but didn't go forward with it. In December, it all but said it was going to do this, after all, by splitting itself up internally. Now it's doing it for real.

Comcast is doing the same thing.

Last October, Comcast said it would bundle almost all of its cable channels into a separate company (which it's calling Versant, for some reason) and hang onto its movie and TV studio and its Peacock streaming service.

Like Comcast, WBD insists that no, really, it's splitting off its cable TV networks so they can grow and thrive on their own, and you'd be lucky to buy a piece of them.

"The global networks business is a real business," WBD CEO David Zaslav said on the company's investor call Monday morning.

That is definitely true, since those cable networks continue to generate profits. It's also something you don't normally feel compelled to say when you're selling something people want to buy.

Because the big picture here is that both WBD and Comcast have concluded what investors — and people who watch things on TV — have concluded long ago: The cable TV business is a shrinking business, as more and more people cut the cord or simply never sign up for one. And the people who continue to watch cable TV are getting older and smaller in number.

The WBD split will generate all kinds of questions to ponder. Some of them are technical: How will WBD's $35 billion in debt be split up between the companies? How will the split companies approach future distribution deals with the likes of Comcast and Charter? How quickly could Comcast and WBD combine their two cable groups into one bigger cable group? Will the split help WBD's stock (it's up Monday — but note that Comcast also spiked when it announced its deal last fall, and has fallen some 20% since)?

Some questions the WBD split can generate may also matter to people who don't care about corporate finance. Such as: What does this mean for the future of CNN — the news channel that's struggling to find a lane in a loud and crowded media environment, but whose brand still has lots of potential value?

But the big takeaway is the obvious takeaway: The people who run the biggest collections of cable TV channels in the country would like someone else to own them. Because every quarter, the number of people who watch those channels and pay for those channels gets smaller.

Like I said late last year: These are garage sales. Maybe someone will want to own shrinking businesses that still throw off lots of cash (paging private equity). But the people who have them now think they'd be better off without them. Buyer beware.

© Hulu

© Marvel Studios/Disney+

© Disney

© Prime Video

© Amazon

Hi, friends! Welcome to Installer No. 86, your guide to the best and Verge-iest stuff in the world. (If you're new here, welcome, hope you've cleared your schedule for some Karting this weekend, and also you can read all the old editions at the Installer homepage.)

This week, I've been reading about privacy experts and spreadsheets and Dropout, watching Stick for fun and Mike and Molly for a wedding toast (long story), learning some sweet new Raycast tricks, talking into my phone with Wispr Flow, replaying Jon Bellion's new album, holding space for the next Wicked movie, and seeing if maybe the solution to my to-do list chaos is just a piece of paper. So far, it's working, and I hate it.

I also have for you a delightful new way to take pictures on your iPhone, the big new title for the Switch 2, a long interview with a Microsoft CEO, a fun way to soundtrack your pool parties, and much more. It's going to be a game-filled next few weeks, friends. Let's do it.

(As always, the best part of Installer is your ideas and tips. What do you want to want to know more about? What are you playing / watching / reading / listening to / plugging into your TV this week? Tell me everything: in …

© Franco Arland/Getty Images

© Markus Gilliar - GES Sportfoto/Getty Images

© Amazon / Prime Video

© Lionsgate

© Apple TV Plus / YouTube