Prediction: Lucid Group Sales Will Soar 500% Over the Next 5 Years if This Happens

Key Points

Lucid Group is ready to tackle a $10 trillion opportunity.

There's another growth catalyst that could generate even more near-term growth.

Lucid Group (NASDAQ: LCID) investors are ecstatic about the company's recent deal with Uber Technologies. Another electric vehicle (EV) stock, Tesla, has been aggressively ramping up its robotaxi efforts this year. Some experts believe this could eventually be a $10 trillion opportunity. So when Uber and Lucid partnered to launch their own robotaxi businesses, Lucid stock soared by more than 40% on the news.

While autonomous driving is an exciting pillar of growth, there's actually another growth catalyst that will matter even more in the near future. In fact, this catalyst could help Lucid grow sales by more than 400% over the next five years alone.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Tesla has already shown Lucid Group how to grow rapidly

When it comes to scaling a $1 trillion electric vehicle business, Tesla has already shown the way. In fact, CEO Elon Musk detailed his master plan for growth all the way back in 2006 when he wrote up his strategy for the coming years. First, he wanted to build a sports car. That goal was achieved with the Roadster, a powerful but very expensive initial use case. From that, Musk wrote that he would use the money from that car's sales "to build an affordable car." This was achieved with the launch of the Model X and Model S. Those two, however, were still often priced above $100,000.

This brings us to Musk's final step in his master plan for growth: Use the money earned from Model X and Model S sales "to build an even more affordable car." This was first achieved in 2016 with the unveiling of the Model 3, and then again in 2019 when the Model Y was revealed. Both models had options that cost under $50,000. Crossing this threshold finally made Teslas affordable to tens of millions of new buyers.

What happened after Tesla launched its two most affordable models? In the years that followed, sales doubled and then tripled. Today, the Model 3 and Model Y alone account for more than 90% of Tesla's car sales. If an EV maker wants to grow rapidly, it must deliver affordable mass-market vehicles. This is exactly what Lucid Group plans to do starting in 2026, when management expects to begin launching three new mass-market vehicles. If Tesla's history is any indication, sales could double and then triple over the next five years. That could create more than 500% in potential sales upside.

Image source: Getty Images.

Is it time to load up on LCID stock?

There are some very important caveats to this story, even if the growth potential is clearly laid out.

First, there haven't been any significant updates on Lucid's mass market vehicle program since last year when CEO Peter Rawlinson announced a "new high-volume mid-size electric SUV with a starting price around $48,000," during a conference call. But Rawlinson isn't even the CEO anymore. He departed the company earlier this year. And while the Uber deal brought fresh cash and enthusiasm, Lucid is still losing money every quarter, bringing into question the massive capital investment it would take to get new models on the road.

Second, these types of projects almost always face delays. Tesla has been notorious for overpromising on delivery timelines. But it's not just because its CEO is too optimistic. Bringing new vehicles to market takes a ton of money and new infrastructure. If Lucid grows sales by 500% over the next five years, it will be because it manages to stay surprisingly on schedule for production and delivery.

Finally, there is no guarantee that the market will love new Lucid models as much as it loved Tesla's Model 3 and Model Y. At the time, Tesla faced far less competition in the EV space, and it also enjoyed greater name recognition. But with a market cap of just $6.4 billion, the bull case for Lucid remains clear. Sales could grow immensely over the next five years if it can manage to launch and scale its affordable models similar to what Tesla achieved.

Should you invest $1,000 in Lucid Group right now?

Before you buy stock in Lucid Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lucid Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

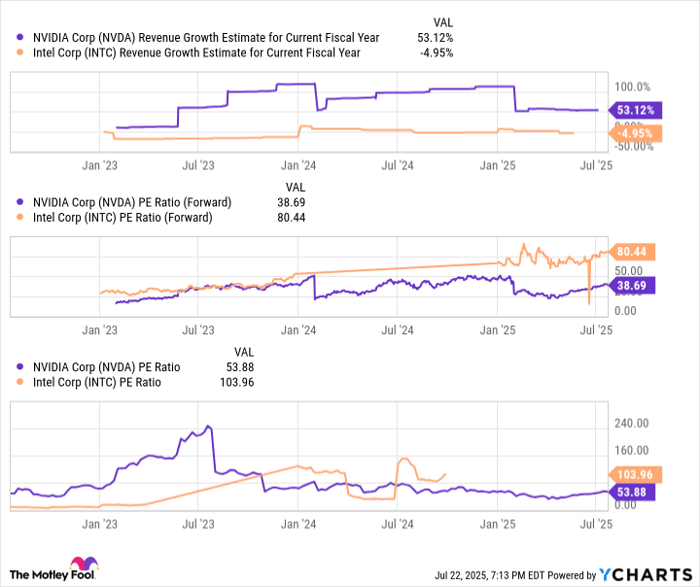

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla and Uber Technologies. The Motley Fool has a disclosure policy.