The Smartest Ethereum ETF to Buy With $500 Right Now

Key Points

The iShares Ethereum Trust (ETHA) has attracted more assets than any other Ethereum ETF, with 42% of asset inflows in just the past month.

BlackRock's backing provides institutional credibility and virtually unlimited financial resources behind the fund.

Buying Ethereum through an ETF eliminates the need for crypto wallets, special exchanges, and fractional coin calculations.

Exchange-traded funds (ETFs) based on the real-time price of Ethereum (CRYPTO: ETH) have been around for a year now. Since the funds were approved and launched in July 2024, Ethereum has gained 7% while the S&P 500 (SNPINDEX: ^GSPC) rose 18%. The leading ETFs have done a great job of tracking this performance precisely, even if the cryptocurrency has been lagging behind stocks recently.

But one ETF stands apart from the rest in many ways. If you're planning to enter the Ethereum market via an ETF, the iShares Ethereum Trust (NASDAQ: ETHA) should be at the top of your list. Apart from having the most assets under management (AUM) in its category, the iShares ETF also comes with low fees and a proven fund family.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

So if you have $500 to spend on a crypto investment today, here's why you should consider the iShares Ethereum Trust.

Is Ethereum a good investment?

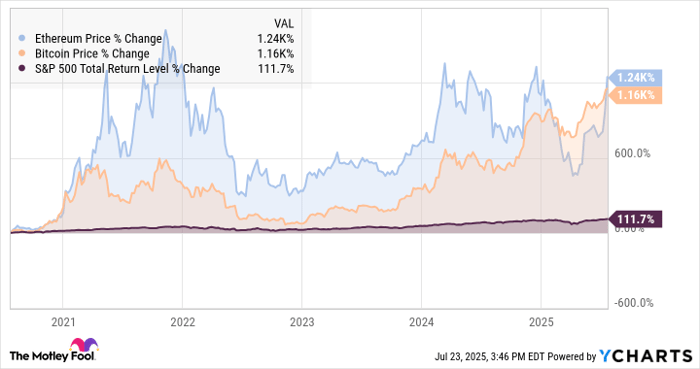

Ethereum is often more volatile than the larger Bitcoin (CRYPTO: BTC) cryptocurrency. For instance, the two crypto giants have both posted approximately 1,200% gains in the last five years, but Ethereum's path to this peak had many more peaks and valleys along the way. The S&P 500 is basically flatlining next to both, even in the midst of the generative artificial intelligence boom:

Ethereum Price data by YCharts

Now, Ethereum serves a very different purpose than Bitcoin. Instead of a fundamental wealth-holding tool, Ethereum's smart contracts help app developers manage financial tools and trends in a global blockchain ledger. So Ethereum's value doesn't spring from a scarce supply, but from real-world usage of the resulting programs.

That makes Ethereum a promising investment if you feel like the financial world could use a whole new set of basic tools. Ethereum-based apps can track ownership of physical assets, execute financial transactions automatically, or manage your digital wallet securely. The Ethereum ledger is readable anytime, from anywhere.

At the same time, its encryption effectively makes all of this transaction data immune to hacking and fraud attacks. On this platform, developers can build a wide variety of financial apps, mobile games, and so on.

So if you see a market for this sort of thing in the long run, Ethereum has led the blockchain-based app development space for years. It's the industry standard -- for good reason. And that should make Ethereum a solid investment over the years, as decentralized app development continues to gain traction.

Image source: Getty Images.

Why buy via an Ethereum ETF?

Buying Ethereum directly often means setting up a new account with a different type of brokerage -- one that can handle cryptocurrency trades rather than stock transactions. You also need to get comfortable with a different type of transaction, where you're usually trading fractions of a digital coin rather than batches of full shares of a stock. Prices are always changing, and you have to figure out where to store your new Ethereum coins.

ETFs make the whole process much easier, assuming you already have a stock-trading brokerage account. These funds act just like stocks, with shares usually priced in a comfortable range. A few iShares Ethereum Trust shares at $27 apiece can be more comfortable than a single Ethereum coin at $3,640.

What makes the iShares ETF special?

As mentioned, the iShares fund is more popular and therefore more liquid than other Ethereum-based ETFs. This makes trading safer and easier, with more stable share prices and quicker transactions.

It's part of the world-famous iShares fund family, next to the even more popular iShares Bitcoin ETF (NASDAQ: IBIT) and the massive iShares Core S&P 500 ETF (NYSEMKT: IVV). Financial services giant BlackRock runs the show, giving investors the peace of mind that comes with essentially bottomless financial backing.

And like most of its iShares cousins, this one comes with a low fee ratio. At 0.25% per year, it's not exactly the cheapest Ethereum ETF to own, but it comes close to the lowest-cost Grayscale Ethereum Mini Trust (NYSEMKT: ETH) at 0.15%. The BlackRock backing and world-class liquidity can make up for this small gap, and some Ethereum ETFs come with fee ratios as high as 2.5%.

The iShares Ethereum Trust is only pulling away from the competition, too. With 42% of AUM inflows over the last month, this fund added more AUM than any other Ethereum ETF has done year to date.

You should consider the iShares Ethereum Trust before any other fund in this category. It's a great place to put your next $500 (about 18 shares) of investable cash to work. Market makers broadly agree, judging by the dominant inflows of more funding.

Should you invest $1,000 in iShares Ethereum Trust - iShares Ethereum Trust ETF right now?

Before you buy stock in iShares Ethereum Trust - iShares Ethereum Trust ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Ethereum Trust - iShares Ethereum Trust ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Anders Bylund has positions in Bitcoin, Ethereum, iShares Bitcoin Trust, and iShares Ethereum Trust - iShares Ethereum Trust ETF. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.