Reading view

Crack the code to startup traction with insights from Chef Robotics, NEA, and ICONIQ at TechCrunch Disrupt 2025

Massive News for Intel Stock Investors!

Intel's (NASDAQ: INTC) management team provided critical insights long awaited by investors.

*Stock prices used were the afternoon prices of July 30, 2025. The video was published on Aug. 1, 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,823!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,064,820!*

Now, it’s worth noting Stock Advisor’s total average return is 1,019% — a market-crushing outperformance compared to 178% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 29, 2025

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Intel. The Motley Fool recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy. Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

What's Going on With Intel Stock?

Intel (NASDAQ: INTC) reported quarterly financial results that reveal critical insights about its turnaround efforts.

*Stock prices used were the afternoon prices of July 29, 2025. The video was published on July 31, 2025.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,823!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,064,820!*

Now, it’s worth noting Stock Advisor’s total average return is 1,019% — a market-crushing outperformance compared to 178% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 29, 2025

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Intel. The Motley Fool recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy. Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

These 2 Indicators Suggest Bitcoin Could Soon Double

Key Points

Bitcoin's price doesn't move in a vacuum.

The global money supply is a key driver of its growth or lack thereof.

The strength of the U.S. dollar is also a very important factor to consider.

Markets are full of complicated gauges, but sometimes the simplest ones deliver the cleanest signal. Right now, the U.S. Dollar Index (DXY) is sliding while the global M2 money supply is swelling, and those two shifts have historically been rocket fuel for crypto assets, particularly Bitcoin (CRYPTO: BTC).

At roughly $118,000 per coin, up about 29% so far this year, Bitcoin sits at an inflection point where fresh liquidity and a softer dollar could converge into a powerful updraft, doubling it from here. Understanding these two indicators is key to predicting what might happen next.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

As the dollar sags, Bitcoin runs

Across Bitcoin's 16-year history, pronounced dollar weakness has usually coincided with strong upside for the coin.

As fate would have it, the DXY -- which measures the value of the U.S. dollar against a basket of foreign currencies -- recently printed its deepest dive below its 200-day moving average in 21 years, precisely as Bitcoin is climbing to touch its all-time highs.

In every major crypto bull cycle, like 2013, 2017, and 2021, a falling value of DXY preceded or paralleled Bitcoin's advance. The mechanism is straightforward. As the greenback loses purchasing power, investors hunt for scarce, nonsovereign assets that can hold value across borders, like gold (which is at a high-water mark as well) and like Bitcoin.

Image source: Getty Images.

Dollar softness may not be transitory this time around. There could be a couple of interest rate cuts by the Federal Reserve before the end of 2025, signaling easier monetary policy ahead. A cheaper dollar, combined with a shrinking pool of newly minted Bitcoin courtesy of its halving in 2024, will tighten the supply-and-demand vise in favor of Bitcoin holders even further.

Still, correlation is not destiny. During prior pivots to risk-off periods, both Bitcoin and the dollar have fallen together. However, short-term dislocations aside, a persistently weaker DXY tilts the long-term odds toward higher Bitcoin prices.

The global money supply is expanding again

While the dollar stumbles, the total pool of money sloshing around the world just hit an all-time high.

The global M2 money supply indicator, which counts cash plus liquid deposits across the 21 largest central banks, climbed to $55.5 trillion in July, reclaiming the growth trend that paused in 2023.

That matters because Bitcoin historically tracks M2 growth with a loose but meaningful correlation. When liquidity accelerates, investors have more capital to deploy into scarce assets, and Bitcoin's hard cap of 21 million coins makes it an obvious candidate on that front.

Central banks are also greasing the wheels here. India's Reserve Bank has already slashed its repo rate and cut its reserve requirements to inject cash into markets. China's central bank has committed to a fairly loose stance, preparing further liquidity injections to shore up demand domestically. Those moves echo shifts at other major central banks and point to a broad, synchronized easing cycle which will send the money supply even higher.

Assuming Bitcoin simply maintains its historical elasticity to rising liquidity, a 1% jump in global M2 growth has often translated into 65% or higher returns for the coin within the following 12 to 18 months. Starting from today's $118,000 price tag, even a conservative reading of that relationship suggests a doubling toward $240,000 is thus feasible on the basis of the M2's recent expansion, though not guaranteed.

What investors should consider

The past can't predict the future, and while I'm optimistic about these money moves pushing Bitcoin drastically higher, investors should remember that more money supply can stoke inflation, prompt surprise rate hikes, or flow into entirely different asset classes. Still, with the dollar on the back foot and central banks printing money again, Bitcoin looks unusually well positioned, and it could well double from here.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,823!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,064,820!*

Now, it’s worth noting Stock Advisor’s total average return is 1,019% — a market-crushing outperformance compared to 178% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 29, 2025

Alex Carchidi has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

Kleiner Perkins-backed Ambiq pops on IPO debut

How a New Jersey startup found an electrifying way to slash copper costs

Should You Forget Intel and Buy These 2 Tech Stocks Instead?

Key Points

Intel is undergoing a large restructuring under new CEO Lip-Bu Tan.

AMD continues to take market share from Intel in the PC segment.

TSMC has become the world's dominant chip manufacturer.

Intel (NASDAQ: INTC) may be unrivaled in the tech sector in its underperformance in recent history. Over the last 10 years, the stock is down 26% even as many of its semiconductor peers and the "Magnificent Seven" have delivered monster returns.

Intel's recent earnings report highlighted the company's multiple challenges as new CEO Lip-Bu Tan has embarked on a massive right-sizing campaign. The company has already laid off 15% of its workforce. It's spinning off its networking and edge business, turning Intel into a stand-alone company that can take on outside investment. It's also taken more impairments for equipment that's no longer useful.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

That's all part of Tan's strategy of refocusing the business on core priorities like AI, its x86 CPU franchise, and the launch of a foundry for its 18A process.

Some investors continue to bet on Intel's eventual turnaround, but the latest report shows that's likely to take longer than investors had hoped. Instead of buying Intel, investors are better off buying these two stocks that are capitalizing on the company's struggles.

Image source: Getty Images.

1. Advanced Micro Devices

While Intel has struggled over the last decade, Advanced Micro Devices (NASDAQ: AMD) has emerged as a winner, grabbing market share from Intel in the PC-focused client segment.

It's also proven itself to be more nimble, shedding its foundry business to become a fabless designer, and it's emerged as the closest challenger to Nvidia in AI graphics processing units (GPUs), though it's a distant second behind the leader. AMD has made several acquisitions of start-ups in AI to bolster its product offerings and make it more competitive.

AMD is also growing much faster than Intel, showing it's capitalizing on the AI boom. It hasn't reported second-quarter results yet, but in its first quarter, revenue rose 36% to $7.44 billion, driven by its success in both the data center, where revenue jumped 57% to $3.7 billion, and in the client segment, where revenue jumped 68% to $2.3 billion on the strength of its Zen 5 Ryzen processors.

By contrast, Intel reported a 3% revenue decline in its client segment to $7.9 billion. As those numbers show, Intel is still the leader in PC chips, but AMD is rapidly gaining market share. The client segment is also Intel's biggest, making up nearly half of its revenue before intersegment eliminations.

Finally, AMD is in a strong position because it has healthy franchises in both central processing units (CPUs) and GPUs, which should benefit it in the AI era.

2. TSMC

In the foundry business, Intel's primary competitor is TSMC (NYSE: TSM), or Taiwan Semiconductor Manufacturing. In fact, it's not a close competition at this point as Taiwan Semiconductor makes up more than half of the contract chips in the world and roughly 90% of advanced chip production in the world, even manufacturing advanced chips for Intel.

Intel has aspirations of challenging TSMC in the contract business, but at this point, the legacy chip maker is far behind, and it will take years for that strategy to materialize.

In the meantime, Taiwan Semiconductor continues to post blistering growth. In Q2, it reported 44.4% revenue growth in U.S. dollars to $30.1 billion, and profits have soared as well, as earnings per share jumped 60.1% to $2.47.

Thanks to its dominance of the contract foundry business and relationships with tech giants like Nvidia and Apple, TSMC enjoys huge operating margins, which came in at 49.6% in Q2. By comparison, Intel is struggling to turn a profit.

TSMC now makes most of its revenue from advanced chips, which it defines as 7 nanometers (7nm) or less. That strength in advanced chips also positions it to continue to take advantage of growth in AI.

Considering its growth rate, TSMC's valuation also looks attractive at a price-to-earnings ratio of 29. As rivals like Intel and Samsung have faltered, TSMC's leadership position has become even more dominant. The stock looks set to continue being a winner.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $630,291!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,075,791!*

Now, it’s worth noting Stock Advisor’s total average return is 1,039% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 29, 2025

Jeremy Bowman has positions in Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy.

Delta’s AI spying to “jack up” prices must be banned, lawmakers say

One week after Delta announced it is expanding a test using artificial intelligence to charge different prices based on customers' personal data—which critics fear could end cheap flights forever—Democratic lawmakers have moved to ban what they consider predatory surveillance pricing.

In a press release, Reps. Greg Casar (D-Texas) and Rashida Tlaib (D-Mich.) announced the Stop AI Price Gouging and Wage Fixing Act. The law directly bans companies from using "surveillance-based" price or wage setting to increase their profit margins.

If passed, the law would allow anyone to sue companies found unfairly using AI, lawmakers explained in what's called a "one-sheet." That could mean charging customers higher prices—based on "how desperate a customer is for a product and the maximum amount a customer is willing to pay"—or paying employees lower wages—based on "their financial status, personal associations, and demographics."

© Hongwei Jiang | iStock / Getty Images Plus

The Smartest Ethereum ETF to Buy With $500 Right Now

Key Points

The iShares Ethereum Trust (ETHA) has attracted more assets than any other Ethereum ETF, with 42% of asset inflows in just the past month.

BlackRock's backing provides institutional credibility and virtually unlimited financial resources behind the fund.

Buying Ethereum through an ETF eliminates the need for crypto wallets, special exchanges, and fractional coin calculations.

Exchange-traded funds (ETFs) based on the real-time price of Ethereum (CRYPTO: ETH) have been around for a year now. Since the funds were approved and launched in July 2024, Ethereum has gained 7% while the S&P 500 (SNPINDEX: ^GSPC) rose 18%. The leading ETFs have done a great job of tracking this performance precisely, even if the cryptocurrency has been lagging behind stocks recently.

But one ETF stands apart from the rest in many ways. If you're planning to enter the Ethereum market via an ETF, the iShares Ethereum Trust (NASDAQ: ETHA) should be at the top of your list. Apart from having the most assets under management (AUM) in its category, the iShares ETF also comes with low fees and a proven fund family.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

So if you have $500 to spend on a crypto investment today, here's why you should consider the iShares Ethereum Trust.

Is Ethereum a good investment?

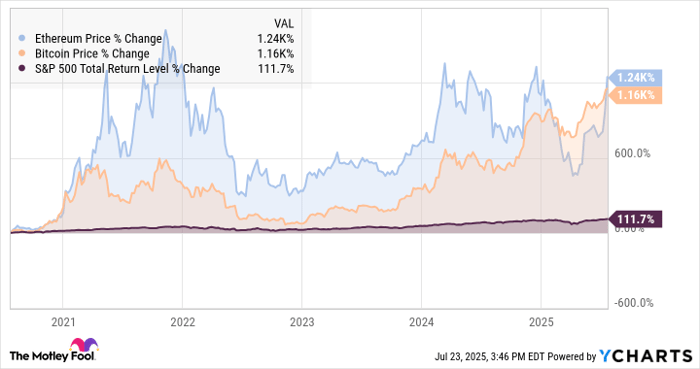

Ethereum is often more volatile than the larger Bitcoin (CRYPTO: BTC) cryptocurrency. For instance, the two crypto giants have both posted approximately 1,200% gains in the last five years, but Ethereum's path to this peak had many more peaks and valleys along the way. The S&P 500 is basically flatlining next to both, even in the midst of the generative artificial intelligence boom:

Ethereum Price data by YCharts

Now, Ethereum serves a very different purpose than Bitcoin. Instead of a fundamental wealth-holding tool, Ethereum's smart contracts help app developers manage financial tools and trends in a global blockchain ledger. So Ethereum's value doesn't spring from a scarce supply, but from real-world usage of the resulting programs.

That makes Ethereum a promising investment if you feel like the financial world could use a whole new set of basic tools. Ethereum-based apps can track ownership of physical assets, execute financial transactions automatically, or manage your digital wallet securely. The Ethereum ledger is readable anytime, from anywhere.

At the same time, its encryption effectively makes all of this transaction data immune to hacking and fraud attacks. On this platform, developers can build a wide variety of financial apps, mobile games, and so on.

So if you see a market for this sort of thing in the long run, Ethereum has led the blockchain-based app development space for years. It's the industry standard -- for good reason. And that should make Ethereum a solid investment over the years, as decentralized app development continues to gain traction.

Image source: Getty Images.

Why buy via an Ethereum ETF?

Buying Ethereum directly often means setting up a new account with a different type of brokerage -- one that can handle cryptocurrency trades rather than stock transactions. You also need to get comfortable with a different type of transaction, where you're usually trading fractions of a digital coin rather than batches of full shares of a stock. Prices are always changing, and you have to figure out where to store your new Ethereum coins.

ETFs make the whole process much easier, assuming you already have a stock-trading brokerage account. These funds act just like stocks, with shares usually priced in a comfortable range. A few iShares Ethereum Trust shares at $27 apiece can be more comfortable than a single Ethereum coin at $3,640.

What makes the iShares ETF special?

As mentioned, the iShares fund is more popular and therefore more liquid than other Ethereum-based ETFs. This makes trading safer and easier, with more stable share prices and quicker transactions.

It's part of the world-famous iShares fund family, next to the even more popular iShares Bitcoin ETF (NASDAQ: IBIT) and the massive iShares Core S&P 500 ETF (NYSEMKT: IVV). Financial services giant BlackRock runs the show, giving investors the peace of mind that comes with essentially bottomless financial backing.

And like most of its iShares cousins, this one comes with a low fee ratio. At 0.25% per year, it's not exactly the cheapest Ethereum ETF to own, but it comes close to the lowest-cost Grayscale Ethereum Mini Trust (NYSEMKT: ETH) at 0.15%. The BlackRock backing and world-class liquidity can make up for this small gap, and some Ethereum ETFs come with fee ratios as high as 2.5%.

The iShares Ethereum Trust is only pulling away from the competition, too. With 42% of AUM inflows over the last month, this fund added more AUM than any other Ethereum ETF has done year to date.

You should consider the iShares Ethereum Trust before any other fund in this category. It's a great place to put your next $500 (about 18 shares) of investable cash to work. Market makers broadly agree, judging by the dominant inflows of more funding.

Should you invest $1,000 in iShares Ethereum Trust - iShares Ethereum Trust ETF right now?

Before you buy stock in iShares Ethereum Trust - iShares Ethereum Trust ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Ethereum Trust - iShares Ethereum Trust ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Anders Bylund has positions in Bitcoin, Ethereum, iShares Bitcoin Trust, and iShares Ethereum Trust - iShares Ethereum Trust ETF. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.

This Artificial Intelligence (AI) Stock Has Big Potential and a Surprisingly Low Price

Key Points

Artificial intelligence (AI) spending could reach $4.8 trillion by 2033, and this company stands to benefit.

It's a major AI player and still trading at an attractive valuation for long-term investors.

If you're looking for massive growth potential, check out artificial intelligence (AI) stocks. According to the U.N., the AI market is set to explode from a $189 billion valuation in 2023 to nearly $5 trillion by 2033. However, despite these massive projections, one of the most popular AI stocks on the market today remains surprisingly cheap.

This popular AI stock is cheaper than you think

Looking for an AI stock that can directly benefit from a massive jump in demand over the next decade and beyond? Check out Nvidia (NASDAQ: NVDA). While many investors are already familiar with the company, you may not realize how cheap the stock actually is. Fortunes have already been made with Nvidia stock. But there's still plenty of room left to run.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Before we jump into Nvidia's surprisingly cheap valuation, let's quickly review what makes this stock so special.

Nvidia is the largest GPU stock in the world. Its hardware powers data centers worldwide -- data centers that AI developers rely on to build, train, and deploy their models. End users, too, rely on data centers to use AI services, putting Nvidia's GPUs at the center of the AI value chain. Recent estimates suggest that the company may have a market share of 90% or more for GPUs designed for AI use cases.

How did Nvidia get so dominant? According to William Blair analyst Sebastien Naji, Nvidia invested heavily to develop "the broadest ecosystem" of software tools and developers, which essentially allows it to control both the hardware and software components of its GPUs. "And so it's just so much easier to build an application, build an AI model on top of those chips," Naji adds.

Image source: Getty Images.

Nvidia got a lead on the AI GPU market through early investment. Its software focus, meanwhile, allowed users to customize their chips, creating a "stickiness" to its products. Switching to a competing chip isn't just a matter of hardware, but also software integration, providing Nvidia with a durable moat around its business model.

Nvidia's sales have grown in the heavy double digits for years. And its gross margins lead the industry. And yet, as we'll see, shares remain surprisingly cheap.

Is now the time to invest in Nvidia?

On the surface, Nvidia stock looks expensive. Shares trade at nearly 30 times sales -- a huge premium for a multitrillion-dollar stock. But on a profit basis, the situation improves dramatically.

Yes, Nvidia shares are trading at 54 times trailing earnings. But because sales are growing so quickly, it's important to look at the company's forward valuation. Based on what the company is expected to earn over the next 12 months, shares trade at just 39 times forward earnings.

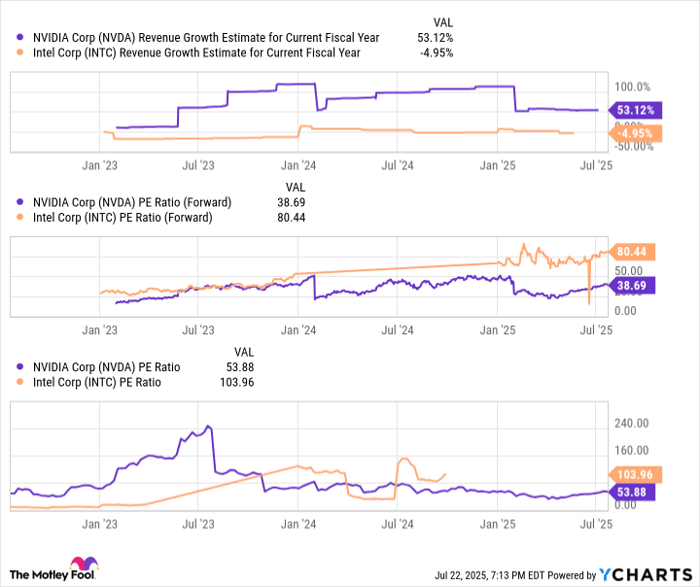

Meanwhile, Intel, another chipmaker, is struggling to remain profitable. Its revenues are expected to fall by around 5% over the next fiscal year. The firm failed to invest in the AI opportunity, and the company is struggling to remain relevant in the next-gen GPU space. By comparing Intel and Nvidia on some key metrics, we can easily ascertain Nvidia's core strengths. Nvidia is positioned well for the near term and the long term. Intel's fate, meanwhile, remains uncertain for both time frames.

NVDA Revenue Growth Estimate for Current Fiscal Year data by YCharts

Compared to competitors like Intel, Nvidia is doing quite well. But is 39 times earnings actually a "bargain" valuation? It is if you keep doing the math. The AI market is expected to continue growing by 20% to 30% annually for nearly a decade. With the S&P 500 (SNPINDEX: ^GSPC) trading at 30 times earnings, it won't be long until Nvidia stock trades below the general market based on today's trading price.

The key here is patience. If you're willing to hold Nvidia stock for the long term, high sustained growth rates will quickly eat into the up-front valuation premium, making the stock a bargain in hindsight. As with any high-multiple stock, expect plenty of volatility along the way. But if you're betting on AI stocks for the long haul, Nvidia remains surprisingly cheap for patient shareholders.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Intel and Nvidia. The Motley Fool recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy.

Sam Altman warns there’s no legal confidentiality when using ChatGPT as a therapist

Intel Boosted by Strong PC Sales

Key Points

Intel beat Wall Street revenue expectations but posted an unexpected loss due to charges related to streamlining.

The company, under new CEO Lip-Bu Tan, is taking decisive action to get costs in line.

These are the early days of what figures to be a long turnaround, but the initial results provide some reason for optimism.

Here's our initial take on Intel's (NASDAQ: INTC) fiscal 2025 second-quarter financial report.

Key Metrics

| Metric | Q2 2024 | Q2 2025 | Change | vs. Expectations |

|---|---|---|---|---|

| Revenue | $12.8 billion | $12.9 billion | 1% | Beat |

| Adjusted EPS | $0.02 | -$0.10 | n/m | Missed |

| Gross margin | 35.4% | 27.5% | -790 bp | n/a |

| Intel Foundry revenue | $4.3 billion | $4.4 billion | 2% | n/a |

Intel Works to Get Its House in Order

Intel posted better-than-expected revenue in the second quarter but noted an unexpected loss due to impairment charges related to "excess tools with no identified reuse." This is the first full quarter under new CEO Lip-Bu Tan, who joined in March, and the new chief executive outlined his plan for the company, including significant cost cuts.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Intel management said it has completed the majority of a plan to cut its workforce by 15% and is taking action to optimize its manufacturing footprint. The company said it no longer intends to move forward with planned projects in Germany and Poland. In addition, Intel said it would "further slow" the pace of construction at a plant in Ohio to ensure the spending is aligned with market demand.

Revenue was boosted by strong demand from the personal-computer business, driven by efforts by PC makers to boost inventories ahead of potential tariffs. The company's client computing group, which includes PCs, saw revenue grow by $300 million on a sequential-quarter basis to $7.6 billion.

Intel's Foundry unit, which has been touted as a future driver for growth, did $4.4 billion in revenue in the quarter compared to $4.7 billion in the first quarter of 2025 and $4.3 billion a year ago.

Data center revenue came in at $3.9 billion.

Immediate Market Reaction

Investors seem to be taking the earnings miss in stride. Shares of Intel were up about 2% in after-market trading immediately following the announcement on Thursday but ahead of the company's conference call with investors.

What to Watch

Intel and Tan are at the early stages of a very long journey, with the CEO focused for now on getting costs under control before focusing attention on reestablishing Intel's legacy as an innovation powerhouse. That will take time, and investors can only gather so much information from a single quarter's results.

Intel is guiding for revenue of $12.6 billion to $13.6 billion in the current quarter, which would be down slightly from a year ago at the midpoint. It expects to be breakeven on a per-share basis, which would be substantially better than last year's third-quarter loss.

The jury's still out on Intel. But for those who have bought into the turnaround story, there is ample reason for optimism that Tan is aggressively taking important first steps.

Helpful Resources

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $634,627!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,046,799!*

Now, it’s worth noting Stock Advisor’s total average return is 1,037% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Lou Whiteman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Intel. The Motley Fool recommends the following options: short August 2025 $24 calls on Intel. The Motley Fool has a disclosure policy.

Former Y Combinator, a16z experts hold invite-only summit for founders

Avalanche Energy hits key milestone on the road to a desktop fusion reactor

How TRIC Robotics is reducing pesticide use on strawberries using UV light

TechCrunch Disrupt 2025: First full agenda reveal for the brand-new Going Public Stage

David Sacks and the blurred lines of government service

The perfect pitch: This NEA partner says every founder should answer these 5 questions

Court rules Trump broke US law when he fired Democratic FTC commissioner

A federal judge ruled yesterday that President Trump violated US law when he fired Democrat Rebecca Kelly Slaughter from her position at the Federal Trade Commission.

"Because the law on the removal of FTC Commissioners is clear, and for the reasons explained below, the court will grant Ms. Slaughter's motion for summary judgment and deny Defendants' cross-motion for summary judgment," said the memorandum opinion from Judge Loren AliKhan in US District Court for the District of Columbia.

Trump is appealing the ruling to the DC Circuit court of appeals and yesterday asked the District Court to stay its order while the appeal is pending. The case could end up at the Supreme Court, with the Trump administration seeking to overturn a 1935 precedent that AliKhan cited while ruling in Slaughter's favor.

© Getty Images | Bloomberg