Microsoft, Apple, Amazon, and Meta Just Gave Nvidia Investors Great News

Key Points

Nvidia's top-tier clients are investing huge amounts of money in AI development, and they're partnering with Nvidia.

Several large tech stocks reported strong earnings last week.

Nvidia reports at the end of the month and it tends to beat guidance.

Last week was a busy one for tech followers. Meta Platforms (NASDAQ: META), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Apple (NASDAQ: AAPL) all reported second-quarter earnings, and while they were mostly positive in different ways, artificial intelligence (AI) continued to be a strong trend. That's great news for Nvidia (NASDAQ: NVDA) investors. Let's see what's happening and why investors should get excited about what Nvidia will have to say when it reports quarterly earnings later this month.

Winning with AI

AI has become an enormous growth driver for tech companies, and really all kinds of companies. It unlocks productivity and aids in creativity in ways that make it essential if a company doesn't want to be left behind.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Amazon said that its AI business through the Amazon Web Services (AWS) cloud division continues to grow at triple digits year over year, "with more demand than we have supplied for at the moment." It's launching all sorts of new features as demand grows and changes, and releasing powerful new tools aimed at developers creating large language models and in need of the highest-power AI chips. It also boasted that it rolled out new EC2 instances, a type of virtual server on the AWS cloud supported by new Nvidia Blackwell "super chips," the most powerful graphics processing units (GPUs) on AWS.

Image source: Getty Images.

Amazon spent $31.4 billion on capital expenditures, which it says is a reasonable estimate for the back half of the year. Although that could be in many parts of the business, it said the AI business is where most of it is going. That means it could be spending even more than the original $100 billion it said it would spend in 2025.

Microsoft boasted that its Azure cloud business is grabbing market share, up 34% year over year in the 2024 fiscal fourth quarter (ended June 30), and that it now has 400 data centers, the most of any other cloud business. Management highlighted that while there's industry talk about the first gigawatt or multi-gigawatt data centers, it launched two gigawatts of power in its data centers over the past 12 months, and it's scaling faster than the competition.

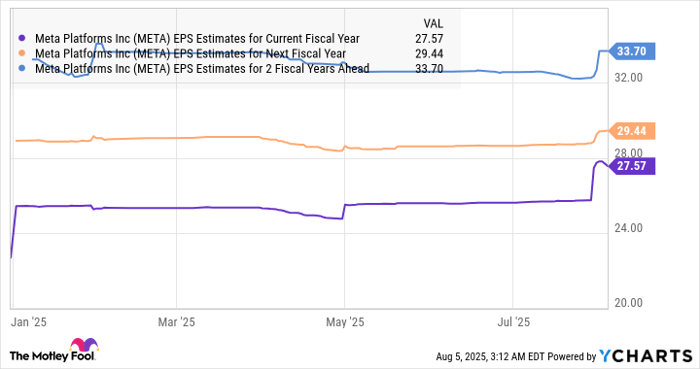

At Meta, CEO Mark Zuckerberg discussed many exciting developments in AI, including the launch of Meta Superintelligence Labs, which combines all of the company's AI efforts, and progress on upgrades to its Llama LLMs. In April, Nvidia announced its own involvement in the new Llama developments. Zuckerberg said Meta is working on the next generation of products "that will push the frontier in the next

year or so." Meta has made headlines over the last few weeks as it crafts a team of AI specialists it's been pulling from rival companies.

Apple continues to disappoint, or at least confuse, investors with its AI developments. It's taking its time to develop an AI infrastructure that rivals the competition, and it's questionable whether or not it's losing ground or if it's going to eventually release something different and special, which is its signature. Management said it's making substantial investments in AI and that its capital expenditures are going to increase.

Although investors seemed disappointed in Apple's AI updates, there's no question that it provided an excellent report, beating expectations on the top and bottom lines, and it's likely to report progress in Apple Intelligence over the coming quarters.

Driving AI

The common denominator here is Nvidia, which partners with all of these companies. It provides the power for Amazon's and Microsoft's clientele to develop potent LLMs and AI agents, and they also use Nvidia GPUs for the data centers that drive their own LLMs. Meta uses Nvidia's GPUs for its own LLMs and AI agents, and Apple partners with Nvidia for its AI business as well.

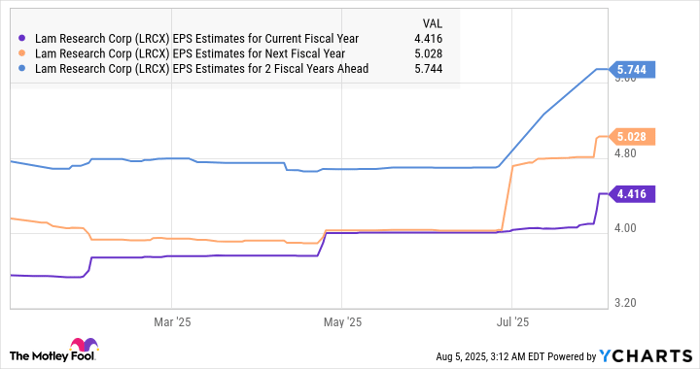

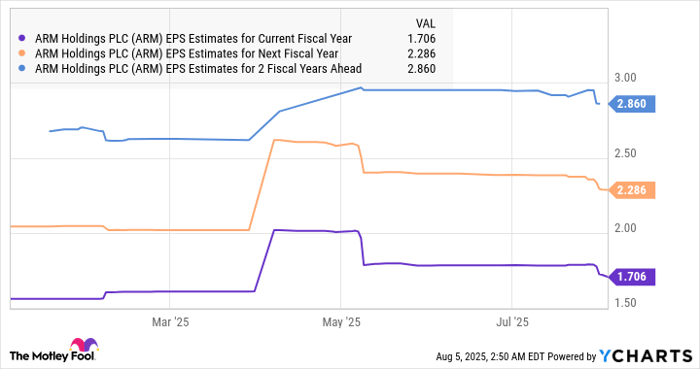

Nvidia is guiding for sales to increase about 50% over last year in the fiscal second quarter, which it will report on Aug. 27. Its quarterly results usually beat guidance, but with the success and continued capital investments of its top-tier clients, it's very likely that it will beat sales guidance and give shareholders a strong outlook.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $653,427!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,119,863!*

Now, it’s worth noting Stock Advisor’s total average return is 1,060% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Jennifer Saibil has positions in Apple. The Motley Fool has positions in and recommends Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.