Big News for Roku Investors (and It's Exactly Why I Decided Against Selling)

There are multiple reasons to believe that stocks are overvalued right now, generally speaking, motivating me to move on from some old duds in my portfolio.

For starters, consider the market for initial public offerings (IPOs). Companies usually wait to go public until market conditions heat up. High stock valuations allow IPO companies to raise more money. After below-average IPO years in 2022, 2023, and 2024, this year is shaping up to be above-average for new listings.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

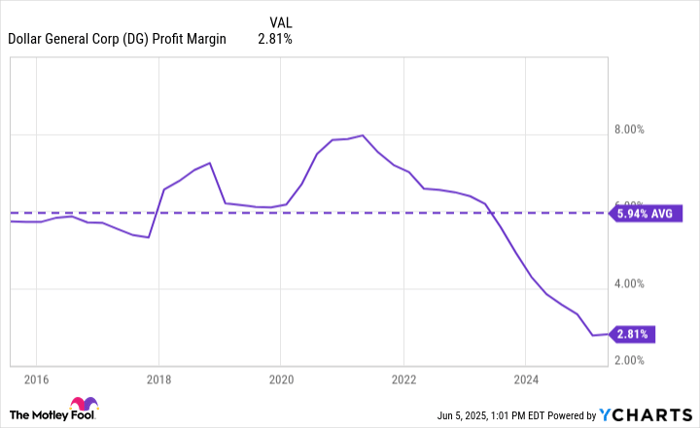

The rise in IPO stocks in 2025 suggests that stock market valuations are high. And this suggestion can be corroborated further. According to YCharts, the price-to-earnings (P/E) ratio for the S&P 500 is 28, well above its 10-year average of 25.

S&P 500 P/E Ratio data by YCharts

Some investors may use this information to "time the market," selling all of their stocks. I believe that's the wrong takeaway -- there's no telling what will happen with the market next. But for me, I have stocks in my portfolio that I'd like to move on from. In my view, now is as good a time as any to sell these, considering the stock market is potentially overvalued.

I recently gave connected-TV platform company Roku (NASDAQ: ROKU) a hard look. I started buying shares in 2020 and continued buying into 2022. My entire position is down about 15% as of this writing, even though the S&P 500 has risen dramatically during my holding period. But I ultimately decided to keep holding for one key reason.

It's early. But so far, I'm happy with my choice. On June 16, Roku secured a deal with Amazon (NASDAQ: AMZN). And it underscores why I still haven't sold Roku stock yet.

Why Roku's potential is sky-high

For eight consecutive quarters, Roku has sold its hardware devices at a gross loss -- it sells them for less than it costs to make them. It does this because it's more interested in taking market share and becoming an advertising-technology (adtech) titan in connected TV (CTV).

When it comes to adtech, TV screens are the most desirable advertising medium, and Roku powers TVs in over 90 million households. Not only is the video format attractive to advertisers, but Roku has an interesting value proposition: It can "close the loop" in advertising.

Over the years, Roku has struck some interesting partnerships with companies such as Kroger, Walmart, and Cox Automotive. Take the Cox Automotive partnership for illustration. It owns the popular Kelley Blue Book platform. Through the partnership, Roku can show marketers how viewers are really responding to vehicle ads. If they see an ad and then head over to Kelley Blue Book for better info, that's an important data point for advertisers.

In this scenario, Roku and Cox Automotive work together to close the loop as much as possible.

Roku's partnerships with Kroger and Walmart can do similar things. Consumer brands could advertise on Roku, know who saw an ad, and know whether they bought anything at Kroger or Walmart as a result. Assuming Roku can demonstrate a high return on advertising spending, demand for its platform should soar, allowing it to command better advertising rates.

Will Roku finally be able to capitalize?

Now Roku is partnering with Amazon, and the potential is similar. Amazon is the largest e-commerce company in the world and perhaps knows more about consumers than any other retailer. This makes Amazon's advertising solutions quite popular and explains how its ads business scaled so quickly.

Through the new partnership, Roku and Amazon hope to deliver a win-win. It's a potential win for Roku because advertisers will have data from Amazon and can better target Roku's viewers. It's a potential win for Amazon also because (in spite of investors' concerns about Amazon's Fire TV) Roku remains the top player in the space.

Image source: Roku.

In short, I believe Roku's partnership with Amazon is big news for investors, and it's exactly the kind of news that's kept me as a shareholder. But allow me to contextualize the news a little more.

Roku's potential has been sky-high, but it has, nevertheless, been a disappointment in recent years.

Roku generated higher average revenue per user (APRU) in 2022 than it did in 2024. And management doesn't even break out this metric anymore, suggesting the numbers are still disappointing. But viewership has increased dramatically. This alone should have lifted ARPU. The only logical explanation is that advertising demand simply hasn't grown as it should, in spite of what Roku's adtech capabilities can theoretically provide.

Roku's partnership with Amazon is expected to officially launch before the end of the year. If the partnership can't materially improve Roku's monetization at some point in 2026, then I don't know what will. Failure to see a substantial improvement with Roku at some point in 2026 could suggest it's finally time to move on from this once-promising stock.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $713,547!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $966,931!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 177% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of June 23, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jon Quast has positions in Roku. The Motley Fool has positions in and recommends Amazon, Roku, and Walmart. The Motley Fool recommends Kroger. The Motley Fool has a disclosure policy.