1 Super Stock Down 81% to Buy Hand Over Fist, According to Wall Street

Key Points

Confluent developed an industry-leading data streaming platform that helps companies create live digital experiences for their customers.

Confluent is tapping into a new opportunity in the artificial intelligence (AI) space, which could be a major growth driver over the long term.

Confluent stock is down 81% from its 2021 record high, and it's the cheapest it has ever been by one popular valuation metric.

Data streaming powers a growing number of our digital experiences every day. Retailers use it to provide us with live inventory information on their websites so we know whether a product is in stock in real time. Investing and sports betting platforms, on the other hand, use it to feed live prices and odds directly to our smartphones.

Confluent (NASDAQ: CFLT) developed an industry-leading data streaming platform, which is now also becoming a critical tool in artificial intelligence (AI) applications, creating a whole new opportunity for the company.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Confluent stock plunged by 30% after it released its operating results for the second quarter of 2025 (ended June 30) last week, and it's now down by 81% from its record high from 2021. But The Wall Street Journal tracks 36 analysts who cover Confluent stock, and the overwhelming majority remain bullish. Therefore, here's why its poor performance could be a long-term buying opportunity.

Image source: Getty Images.

Data streaming is revolutionary

If you wanted to watch a movie at home 20 years ago, you would have to buy or rent a DVD. Today, streaming platforms like Netflix store movies in data centers and feed them directly to your television using the internet. This created a more convenient viewing experience by eliminating the need for DVDs, DVD players, and even movie rental chains like Blockbuster.

Data streaming is conceptually similar. Businesses used to store data in physical servers on-site, and they would analyze it at a later date. Cloud computing providers like Amazon reduced the need for that hardware by allowing them to store their information in centralized data centers, where they can access it online at any time. Data streaming platforms like Confluent enable that information to be ingested, analyzed, and processed in real time, to create unique live experiences.

Retail giant Walmart synced all of its physical and digital sales channels, and it uses data streaming to monitor inventory levels in real time. Therefore, customers can trust Walmart's website when it says a product is in stock. And since the retailer knows the moment a product is sold, it can replenish inventories before they run dry, which ensures customers always find what they are looking for in its physical stores as well.

Shifting gears to AI, businesses can use Confluent to create data pipelines that they can plug into ready-made large language models (LLMs) from developers like OpenAI. In other words, Confluent provides the plumbing that can turn a generic AI chatbot into a tailored assistant that is capable of handling highly specific requests from customers.

Moreover, Confluent says one of its AI customers is an international sports network that is ingesting data from live matches and using it to instantly generate commentary in real time. This wouldn't be possible without high-performance data pipelines.

Confluent beat expectations during the second quarter

Confluent went into the second quarter of 2025 expecting to deliver up to $268 million in subscription revenue (its primary source of revenue). It topped that estimate with $270.8 million, which represented a 21% increase from the year-ago period.

A couple of things contributed to the strong result. First, Confluent's net revenue retention rate was 114%, and while that ticked lower from the previous quarter, it meant existing customers were spending 14% more money with the company than they were a year ago. Second, Confluent attracted new customers of all sizes. The number of customers spending at least $100,000 annually grew by 10% year over year, and the number of customers spending at least $1 million jumped by 24%.

But it wasn't all good news. In his prepared remarks to investors, CEO Jay Kreps said some of Confluent's largest customers continued to optimize their spending, and one AI-native customer is moving away from the platform entirely because it wants to handle its data management internally. Kreps said this will lead to slower revenue growth than initially anticipated in the second half of this year, which is why Confluent stock plunged last week.

With that said, the overall outlook is still positive because management actually increased the low end of its 2025 revenue forecast by $5 million

Wall Street is bullish on Confluent stock

The Wall Street Journal tracks 36 analysts who cover Confluent stock, and 21 have given it a buy rating. Five others are in the overweight (bullish) camp, and nine recommend holding. One analyst has given the stock an underweight (bearish) rating, but none recommend selling.

The analysts have an average price target of $25, which suggests Confluent stock could climb by 45% over the next 12 to 18 months. The Street-high target of $36 implies even more potential upside of 108%.

However, I think the stock could do even better over the long term. Confluent expects production AI use cases to soar tenfold this year among just a few hundred of its customers. It's an early sign that companies are starting to deploy AI software into the real world, and Confluent will benefit as this adoption ramps up.

Moreover, the company values its addressable market at $100 billion across its entire product portfolio, and it barely scratched the surface of that opportunity based on its current revenue.

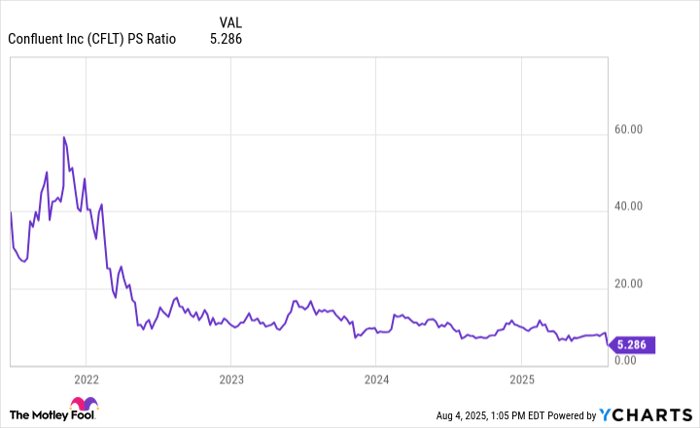

Confluent's price-to-sales (P/S) ratio soared to an unsustainable level of around 60 when its stock peaked during the tech frenzy in 2021. But the 81% decline in its stock, combined with the company's steady revenue growth over the last few years, has pushed its P/S ratio down to just 5.2. That's officially the cheapest level since the stock went public.

CFLT PS Ratio data by YCharts

Therefore, investors who are willing to take a long-term view could be rewarded by buying Confluent stock at the current price. However, they will probably have to endure some volatility along the way.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 1,026%* — a market-crushing outperformance compared to 180% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Netflix, and Walmart. The Motley Fool recommends Confluent. The Motley Fool has a disclosure policy.