3 Reasons to Buy Roku Before Thursday's Close, 1 Reason to Sell

Key Points

Roku reports its second-quarter numbers after Thursday's market close.

A clear path to profitability, improving guidance, and rising partnership prospects can make it a strong performance.

Roku stock has still initially stumbled after posting financial results -- more often than not -- over the past year.

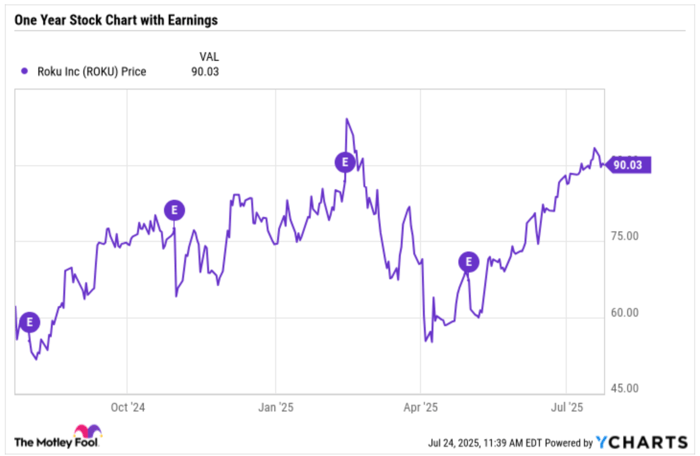

A lot of companies have a lot riding on impressing the market this earnings season. Roku (NASDAQ: ROKU) certainly has a lot to gain -- or lose -- depending on how its fresh financials play out. Shares of the TV video-streaming pioneer have more than doubled the market's return in 2025, and are up a hearty 53% over the past year.

Roku reports its second-quarter results on Thursday afternoon, shortly after the market close. Roku's guidance for the period calls for a net loss of $25 million, improving on the $34 million deficit it posted a year earlier. It sees revenue increasing 10.5% to $1.07 billion. Let's go over a few of the reasons why the shares can move higher on Friday following the telltale earnings release. Let's close with one reason why the reaction may not be so rosy.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

1. Profitability can come sooner than you think

A big knock on Roku has been its lack of profitability. It generated positive net income for a six-quarter stretch from the second half of 2020 to all of 2021, but it has remained in the red outside of that run. It's worth noting that Roku hit an all-time high during that span of time. The stock would have to be a five-bagger from today's starting line to get back there. What if Roku is closer to becoming profitable sooner rather than later?

Roku's guidance three months ago was encouraging. The niche leader sees a loss of $30 million for all of 2025. It already scored a net loss of $27 million for the first quarter. Its outlook calls for a $25 million deficit for the three months that ended in June. If it's still modeling a $30 million hole on the bottom line for the entire year, that would translate into a profit of $22 million for the next two quarters combined.

Will its new guidance show positive net income for the current quarter or will the burden to dig Roku out of the red rest solely on its fourth-quarter performance? What if profitability is already here? Back in February it was calling for a $40 million deficit for both the first quarter and all of 2025. It improved on both of those forecasts when it announced results at the start of May. After 13 consecutive quarters of losses, the bottom-line turnaround could be here.

Image source: Getty Images.

2. Engagement could keep rising

Roku closed the curtain on two of its most popular metrics at the end of last year. It is no longer reporting the number of users on its free operating system. The move also meant the end to putting out average revenue per user (ARPU), as it would be easy math to calculate its audience if you divide platform revenue by ARPU. It's not just Roku doing this. The country's leading premium video service is also no longer putting out its subscriber count.

Thankfully Roku is still offering up the time that folks are spent streaming through the platform. Viewers spent 35.8 billion hours cradling the Roku remote during the second quarter, a nearly 17% year-over-year jump. Since Roku's flagship platform revenue is basically the ability to monetize its audience through ads and nudging viewers to try new services, the streaming hours metric has become even more critical. There are no signs that Roku's popularity is in trouble, and one can argue that extreme weather this summer has probably kept a lot of people at home in front of their TVs.

3. New partnerships can keep emerging

One of the most noteworthy things to happen during the second quarter was a partnership announced with Amazon. The leading online retailer operates a popular demand-side ad buying platform, and in mid-June it announced that it would start offering its advertisers a way to reach Roku's growing user base. The integration is a win-win deal for both parties, even if Amazon's Fire TV competes with Roku.

The fruits of that deal won't move the needle in the second quarter. The unexpected partnership won't be a factor until the latter half of this year. However, Roku will have a chance to discuss the partnership and how it can increase the ARPU that it is no longer reporting. This could also spur other partnerships as Roku establishes itself as the best way for advertisers to get noticed in the era of connected TV marketing. Roku is ready for its close-up as a growth stock again.

Image source: YCharts.

A reason to sell?

Take a closer look at the stock chart above. You'll see Roku moving higher with its 53% surge over the past 12 months. Now zoom in on the purple E circles that point out when it posted its past four quarterly results. The stock has moved lower after announcing fresh financial results three of those four times.

On the one hand, it's encouraging to see that Roku isn't just surviving but actually thriving after initially poorly received quarterly results. However, it could give an investor pause seeing how the market response hasn't been positive the day after Roku's financial updates.

Long-term investors don't have to worry about timing the market. It's also worth noting that the three positive catalysts noted could make this a winning Friday instead of a sinking one. Roku has a lot to prove this week. Stay close to see how it all unfolds.

Should you invest $1,000 in Roku right now?

Before you buy stock in Roku, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Roku wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $630,291!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,075,791!*

Now, it’s worth noting Stock Advisor’s total average return is 1,039% — a market-crushing outperformance compared to 182% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 29, 2025

Rick Munarriz has positions in Roku. The Motley Fool has positions in and recommends Amazon and Roku. The Motley Fool has a disclosure policy.