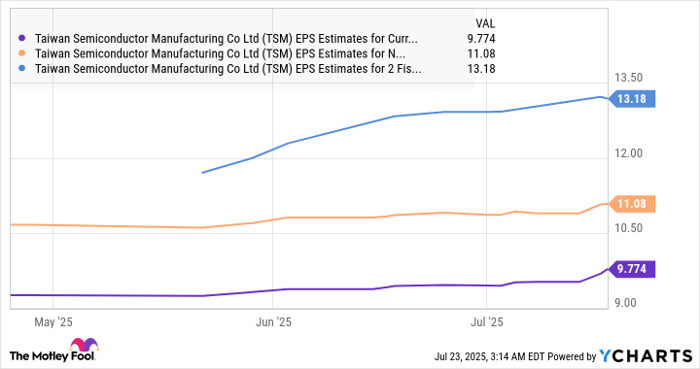

Image source: The Motley Fool.

DATE

Wednesday, May 28, 2025 at 8:30 a.m. ET

CALL PARTICIPANTS

President & Chief Executive Officer — Frank Lee

Chairman & Chief Executive Officer — George Makrokostas

Chief Financial Officer — Eric Rivera

Chief Technology Officer — Chris Progler

Vice President, Investor Relations — Ted Moreau

Need a quote from one of our analysts? Email [email protected]

RISKS

Management stated that mainstream IC demand remains weak due to low wafer fab utilization, with recovery not expected until "even later in 2026."

Eric Rivera noted ongoing macroeconomic uncertainty related to US tariffs is contributing to a "cautious outlook for the rest of the year."

US revenue declined sequentially, attributed to weakness in lower-end design nodes and timing of advanced node projects.

TAKEAWAYS

Total Revenue: $211 million, flat sequentially and down 3% year over year compared to Q2 FY2024, landing within guidance.

IC Segment Revenue: $156 million in IC revenue, down 3% year over year compared to Q2 FY2024, reflecting ongoing design node migration.

High-End Revenue: Rose 2% year over year and constituted 38% of IC revenue, with healthy foundry demand in Asia for 22- and 28-nanometer products.

Mainstream IC Revenue: Declined 6% year over year, with the steepest fall in photomasks for the oldest generation nodes; partially offset by migration to smaller geometries requiring higher value photomasks.

FPD Revenue: $55 million in FPD revenue, down 2% year over year compared to Q2 FY2024, experiencing a low early in the quarter before demand picked up seasonally.

Gross Margin: 37%, matching the quarterly average for the last three years, with leverage improvement driven by operational controls.

Operating Margin: 26%, up 180 basis points sequentially in GAAP operating margin.

Diluted GAAP EPS: $0.15 per share (GAAP); Diluted Non-GAAP EPS: $0.40 non-GAAP diluted EPS per share, after adjusting for foreign exchange.

Operating Cash Flow: $31 million in operating cash flow, equal to 15% of total revenue.

Capital Expenditures: $61 million in capital expenditures, supporting US capacity expansion; CapEx is on track to reach $200 million for FY2025.

Total Cash & Short-Term Investments: $558 million at quarter end.

Share Repurchases: $72 million spent to buy back 3.6 million shares, with $23 million remaining under the repurchase authorization.

Guidance: Q3 FY2025 expected revenue of $200–$208 million; non-GAAP EPS of $0.35–$0.41 for Q3 FY2025; non-GAAP operating margin forecast of 20%–22% for Q3 FY2025.

CEO Transition: Frank Lee announced retirement from the CEO role, with George Makrokostas appointed as the new CEO effective immediately.

Tariff Impact: Rivera stated, "we have determined that these costs will have a negligible impact on our financial results."

Manufacturing Footprint: Photronics operates eleven cleanroom facilities globally, with six in Asia, supporting both capacity expansion and rapid customer response.

SUMMARY

Photronics, Inc. (PLAB) delivered revenue at the midpoint of guidance but cited macroeconomic and tariff-related headwinds that led to cautious forward expectations. Leadership transition was announced, with George Makrokostas elevated to CEO as succession planning continues. Management reiterated that recent share repurchase actions reflect long-term confidence, though visibility for near-term demand remains limited. Geographic and segmental details showed relative resilience in Asia’s high-end foundry demand and in China and Taiwan joint ventures. Customer demand in lower-end nodes and mainstream segments across major geographies was described as muted, with pronounced weakness in automotive and industrial applications.

Eric Rivera said, "ASPs for high-end assets are high, meaning a relatively low number of high-end orders can have a significant impact on our quarterly revenue and earnings."

Makrokostas clarified that future capital deployment will be balanced between US capacity expansion and responding to ongoing growth in Asia, emphasizing a flexible investment approach amid global industry shifts.

Photronics’ capital allocation strategy aims to balance organic growth, strategic investments, and returning cash to shareholders, with an opportunistic stance on future share buybacks.

Based on the transcript, company leadership views its geographic footprint as a key differentiator to address customer needs and mitigate regional tariff risks.

INDUSTRY GLOSSARY

FPD: Flat Panel Display; used for screens in consumer electronics, such as smartphones and laptops.

IC: Integrated Circuit; semiconductor device that integrates numerous tiny transistors.

Node Migration: Transition by customers to semiconductor manufacturing processes employing smaller feature sizes, impacting mask demand and pricing.

AMOLED: Active-Matrix Organic Light-Emitting Diode; a display technology prevalent in high-end devices and adopted in new panel sizes referenced in the call.

G8.6: Refers to the 8.6-generation size standard for large display manufacturing panels.

Full Conference Call Transcript

Ted Moreau: Thank you, operator. Good morning, everyone. Welcome to our review of Photronics' fiscal second quarter 2025 financial results. Joining me this morning are Frank Lee, CEO, George Makrokostas, Chairman, Eric Rivera, CFO, and Chris Progler, CTO. The press release we issued earlier this morning, together with the presentation material that accompanies our remarks, are available on the Investor Relations section of our website. Comments made by any participants on today's call may include forward-looking statements that include such words as anticipate, believe, estimate, expect, forecast, and in our view. These forward-looking statements are subject to various risks and uncertainties, and other factors that are difficult to predict.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We are under no duty to update any of the forward-looking statements after the date of the presentation to conform these statements to actual results. Photronics has provided additional information in its most recent Form 10-K and other subsequent reports filed with the SEC concerning factors that could cause actual results to differ materially. During the course of our discussion, we will refer to certain non-GAAP financial measures. These numbers may be useful for analysts, investors, and management to evaluate ongoing performance.

A reconciliation of these metrics to GAAP financial results is provided in our presentation materials. During the third quarter, we will be participating in the TD Cowen TMT Conference, the DA Davidson Consumer and Technology Conference, the Three Part Advisors East Coast Conference, and the Singular Research Investor Conference. I will now turn the call over to Frank.

Frank Lee: Thank you, Ted, and good morning, everyone. We achieved second quarter sales of $211 million, which was in the middle of our guidance range. Non-GAAP diluted EPS was $0.40. We took advantage of financial market opportunity during the quarter by spending $72 million to repurchase 3.6 million shares, which should drive greater earnings leverage in the future. In our ICM market, chip designs are migrating to higher-end nodes. These nodes require more photomasks per design, which generate higher ASPs per mask set. In the United States, our 2025 capacity expansion plan targets this node migration opportunity. In Asia, we are also in a strong position to benefit from a market transition towards higher-end nodes, as reflected in our Q2 results.

We believe some of the positive node transition trends come from ICs serving a growing AI ecosystem. In the equity market, we are the technology-leading mask suppliers to the industry, including to companies that have their own captive mask operations. Conditions improved during the quarter due to the seasonal timing of major smartphone and laptop design releases. For the first time, these consumer products were produced in larger G8.6 panel sizes using AMOLED display technology. We are optimistic that with more emerging G8.6 related products and R&D activities, our advanced photomask technology will help us gain market share in the coming G8.6 AMOLED era. With the current market dynamics, our geographic footprint is a strategic asset that differentiates Photronics' position.

To support our global customers, we operate eleven cleanroom production facilities, including six in Asia, three in the US, and two in Europe. Our manufacturing facilities located close to our customers enable our rapid response advantage and facilitate collaboration with customers. Our global footprint allows Photronics to capitalize on new business opportunities as the semiconductor industry diversifies its manufacturing footprint. For example, our strategic capacity and capability expansion in the US coincides with the reshoring of semiconductor production to the US. Our program is progressing as planned to support this US customer fab and design roadmaps and expansions. US tariff dynamics during the quarter increased global macroeconomic uncertainty.

While tariff negotiations remain ongoing, we can leverage our diverse geographic footprint as a strategic asset and a competitive advantage. Our ability to allocate production across our geographic locations allows us to ship the majority of masks within regions or countries, mitigating potential tariff costs for our customers. This morning, as part of our carefully considered succession plan, I have decided to retire from the CEO position after three years. I have truly enjoyed my time and am proud of the work we have done to move us forward. I will continue to manage the Photronics' Asia operations until my retirement. I will now introduce you to George Makrokostas, our Chairman, and newly appointed CEO.

George Makrokostas: Thank you, Frank. On behalf of the board and the entire company, I wish to thank you for your twenty years of dedication to Photronics, including the last three years as CEO. You have played a significant role in our success, particularly in our Asia expansion. I look forward to continuing to work with you at Photronics and on the board. By way of introduction, I started my career at Photronics at an entry-level role and worked my way up to a senior leadership position, giving me a thorough understanding of the business and underlying technology. In 2000, I founded RagingWire Data Centers, which became a highly respected data center provider leading to its ultimate sale to NTT in 2018.

I've been a member of Photronics Board of Directors for approximately twenty years, and earlier this year, I was named executive chairman. I look forward to driving Photronics towards the next leg of profitable growth as I focus intensely on operational execution. I will now turn the call over to Eric to review our second quarter results and provide third quarter guidance.

Eric Rivera: Quarter revenue was in line with expectations at $211 million, which was essentially flat sequentially and down 3% year over year. IC revenue of $156 million declined 3% year over year. We noted a continuation of favorable design node migration trends in the quarter, which should continue in the future. High-end revenue increased 2% year over year, representing 38% of our IC revenue. We saw healthy foundry demand for both 22 and 28 nanometer automax products in Asia. Mainstream IC revenue declined 6% year over year, with the largest decline in photomasks serving the oldest generation design nodes, indicating continued weakness in the segment.

This reduction was partially offset by design node migration to smaller IC geometries within mainstream, which require higher value photomasks. By application, revenue from memory applications declined sequentially due to the timing of projects. On the logic side, photomask sets serving mobile communications such as Wi-Fi, Bluetooth, and baseband ICs were strong, along with OLED driver ICs. Lower-end design nodes serving power electronics, automotive, and industrial applications remain in a weaker recovery state. Turning to FPD, revenue of $55 million declined 2% year over year. FPD revenue experienced a low early in the quarter before the anticipated seasonal demand uplift. Higher mobile applications and adoption of advanced mask technologies supporting innovative new designs were areas of strength.

Geographically, revenue was led by our IC joint ventures in China and Taiwan. Business remained healthy as customers rely on Photronics' scale and product mix to support expansion of their product offerings. Revenue from the US declined sequentially due to lower-end design node weakness and the timing of customer advanced node projects. We reported a gross margin of 37%, in line with our quarterly average over the past three years and well above historical levels, as elevated operational controls drove greater than expected leverage across our infrastructure. We recently performed an analysis of the impact of tariffs on our supply chain. Based on current expectations, we have determined that these costs will have a negligible impact on our financial results.

Operating margin of 26% in Q2 was above our guidance range, improved 180 basis points sequentially. Diluted GAAP EPS attributable to Photronics shareholders was $0.15 per share. After removing the impact of foreign exchange, fully diluted non-GAAP EPS attributable to Photronics shareholders was $0.40 per share. Our overall profitability reflects a greater contribution from our joint ventures in China and Taiwan. During the second quarter, we generated $31 million in operating cash flow, which represented 15% of total revenue. CapEx was $61 million in the quarter, which included our planned expansion in the US. We remain on track to spend $200 million in CapEx fiscal 2025 on a combination of capacity, capability, and end-of-life tool initiatives.

Based on current investment plans, we estimate that our CapEx in fiscal 2026 will normalize from elevated fiscal 2025 levels. Total cash and short-term investments at the end of the quarter was $558 million. We have three elements to our capital allocation strategy, including organic growth, strategic investments, and returning cash to shareholders. During the quarter, we spent $72 million to opportunistically repurchase 3.6 million shares and now have $23 million remaining under our existing repurchase authorization. This is a significant endorsement of our confidence in the long-term health of Photronics, and we will remain strategic with respect to future share repurchases. Before providing guidance, I'll remind you that demand for products is inherently uneven and difficult to predict.

We have limited visibility and a typical backlog of one to three weeks. In addition, ASPs for high-end assets are high, meaning a relatively low number of high-end orders can have a significant impact on our quarterly revenue and earnings. Additionally, and as we have highlighted previously, our business is influenced by IC and display design activity and, to a lesser degree, by wafer and panel capacity dynamics. Given market conditions and tariff uncertainty, we remain cautious about the near-term demand environment. We expect third-quarter revenue to be in the range of $200 to $208 million.

Based on those revenue expectations and our current operating model, we estimate non-GAAP earnings per share for the third quarter to be in the range of $0.35 to $0.41 per diluted share, equating to an operating margin between 20% and 22%. I'll now turn the call over to the operator for your questions.

Operator: Our first question comes from the line of Tom Diffely with D.A. Davidson and Company. Your line is now open.

Tom Diffely: Yes. Good morning. Thank you for taking my questions. So first, maybe a little more color on the mainstream business. You said there's continued softness there. I'm curious what you're seeing in kind of the overall supply demand of mainstream mask-making capacity today and how that has impacted the margins, and maybe perhaps how that influenced your capital spending plan this year.

Frank Lee: Thank you, Tom. The mainstream market, as we highlighted in previous calls, still remains weak, mainly because a lot of our age fab customers still have very low wafer fab utilization. I think this trend is something related to the industry, especially in power, industrial, and consumer parts of the business. So I think in the long run, we will still put more focus on building our capacity and capability in high-end and also in the high end of the mainstream. Chris, you want to add some comments?

Chris Progler: Yeah. Thanks, Frank. I can say, you know, Tom, we talked quite a bit about end-of-life tools impacting kind of organic supply of masks in the mainstream. We definitely saw that, but that cycle is starting to move forward. Many companies are replacing those end-of-life tools with new equipment. There has been, because of that, a fair amount of capacity also added to the network globally for mainstream masks. I don't think it's an oversupply situation, but the muted demand Frank talked about and lower utilizations in wafer fabs combined with some capacity increases that were driven by end-of-life tool turnovers has made us somewhat a little bit unfavorable supply-demand balance. But it's not a long-term issue.

It's just a point in the evolution of the mainstream mask supply.

Tom Diffely: So, Chris, are you seeing more of the weakness in Asia right now? And does that have anything to do with some of these kind of startup photomask companies there? And then maybe to follow-up on that, in the US, you're still seeing a migration, it sounds like, of the mainstream to higher-end mainstream. And I guess that is the driver of your increased capital spending this year?

Chris Progler: Yes. So on the first question, not necessarily confined to Asia. The weakness in mainstream on the wafer side is pretty broad-based. Europe may be the strongest example of it because their wafer supply is very much hinged to automotive and industrial microcontrollers and things like that. So it's pretty weak for mainstream in general. So it's not necessarily confined to Asia or new upstarts in China. It's pretty broad-based. Still, the weakness in mainstream. And if you look at the projections for fab utilization and supply for the customers, strong recoveries are not really projected till even later in 2026. So there's a fair amount of supply sloshing around still for mainstream applications in the industry.

As far as our projects in the US, so that's correct. We had a marginal amount of capacity, but also node migration to, let's say, the higher end of the mainstream applications was one of our strategic goals for those investments. And we do think that's a growing part of the market in the US. So that's what we were targeting here.

Tom Diffely: Great. Thanks. And then just looking at the earnings on a year-over-year basis, is the largest impact year-over-year on roughly the same amount of revenue just the margins or pricing in the mainstream world, or would you say there's other factors in there as well?

Frank Lee: Correct. You want to add in pricing? You want the market?

Eric Rivera: Oh, hi, Tom. This is Eric here. So with respect to pricing, I mean, we're trying to, as we discussed previously, we are focusing on product mix. There is a bit of pressure on pricing overall, but we are muting that with product mix. So we're trying to focus on the higher end of mainstream and node migration as Chris just mentioned a few seconds ago.

Tom Diffely: Okay.

Frank Lee: In addition to what Eric just commented, for Photronics, we do have several long-term agreements with many of our main customers. So this long-term agreement not only guarantees the order from the customer but also provides us stable pricing.

Chris Progler: Yeah. And Tom, maybe I can make one more comment on the mainstream because we don't want it to sound like it's all gloom. There's another positive trend we're seeing also with some of the regionalization of the high-end chip makers, foundries, and things like that where starting to look a little more seriously at outsourcing of the lower-end layers of the advanced mask sets. So for example, this might be a five-nanometer node and there's lots of mainstream mask layers in that. Regionalization of fabs is starting to open up some opportunities in mainstream demand for those applications as well. So that's kind of a positive side for the demand.

Tom Diffely: Okay. Great. And I appreciate all the extra color there. And, George, look forward to working with you. I worked with your dad for many, many years, and always a good experience. Could you give us a hint as to what your first focus will be on? Is it, you know, cost structure? Is it driving revenue? Is it saving cost? What in particular do you think you'll be focused on first?

George Makrokostas: Probably all of the above with Frank. You know, Frank has been leading the organization for the last three years and obviously has, you know, more than twenty years with the company. So I'm, you know, looking forward to working with Frank to learn more about Asia. That's not an area that I, you know, have a tremendous experience, and I know more about the US and Europe and the business overall. I'm gonna be working with Frank going forward, you know, to do more of an orderly type of a transition, you know, discipline by discipline. So this is not a wholesale change. It's more of an evolution.

So I would say right now, my focus has been more on the back of house administrative type matters and governance, etcetera. HR, legal, finance, and, you know, now I'm segueing into, you know, more of Frank's responsibilities. But, you know, definitely, we are cost-conscious and want to drive market share. So I think it's both levers. It's, you know, cost reduction containment slash, you know, growing revenue by growing market share. Because as we know, the market is, you know, finite. So we can't necessarily create demand, so we're gonna have to go and, you know, gain market share.

Tom Diffely: I appreciate that. And, Frank, it's been a pleasure working with you the last three years as CEO and, you know, decade plus as the head of Asia before that. Well, thank you, everybody. I appreciate your ability to answer my questions today, and talk to you soon.

Frank Lee: That's excellent. Thank you. Thank you. Thank you.

Operator: Thank you. Our next question comes from the line of Ghoshi Shree with Singular Research. Your line is now open.

Ghoshi Shree: Good morning, guys. Can you hear me?

Chris Progler: Yes. We can.

Frank Lee: Okay. George, congratulations on your new role. Could you share your, kind of, your priorities, like, with regards to US capacity expansion versus balancing your regional utilization efforts due to ongoing growth in Asia?

George Makrokostas: Well, there's definitely gonna be, it appears anyway, there'll be some opportunities here in the US, you know, with TSMC and others and, you know, reshoring and obviously, the geopolitical issues are driving that thought process. And, you know, the creating action by our customer base that we're gonna have to react to. So I would say we're gonna, you know, evaluate the opportunities and deploy capital as we see fit. I think we may have mentioned that we're, you know, expanding our US capacity as it is. We're gonna continue to monitor that and invest, you know, appropriately to, you know, spend CapEx on, but also on, you know, pure capability on the high end as well.

Ghoshi Shree: Okay. Awesome. Given that your top line was just around the midpoint guidance and then you're forecasting a sequential decline, you talked a little bit about the efforts that you would need to take to maybe address the weaker demand. Are these just customers delaying orders due to macroeconomic concerns? And what would it take to kind of lift it in H2?

Eric Rivera: Hello, Ghoshi. This is Eric here. So I think you hit the nail on the head. So we are seeing customers feeling the uncertainty that's reflected in the market. Right? So, you know, the current tariff environment is creating that uncertainty. So that is the reason for our cautious outlook for the rest of the year.

Ghoshi Shree: Okay. And just my last question before. Given that you guys repurchased $72 million even during kind of weaker earnings, how do you prioritize? Are you looking to authorize any expansion of the buyback program if conditions remain challenging?

Chris Progler: Well, we have $23 million remaining under our existing authorization, and we'll continue to be opportunistic with that remaining authorization that we have. And, you know, in terms of looking forward to, you know, increasing that authorization, share repurchases are part of our capital allocation strategy and in doing so, we need to, you know, compare against other investment opportunities that could yield a favorable, you know, return to Photronics to ensure long-term continued growth. So with all those considered, we keep our eyes open and will act appropriately at the appropriate time.

Ghoshi Shree: That's all I had. Thank you guys for taking my questions.

Operator: Thank you. And I'm currently showing no further questions at this time. I'd like to turn the call back over to Ted Moreau for closing remarks.

Ted Moreau: Thank you, Shannon, and thank you everybody for joining us today. We really appreciate your interest in Photronics. And we will be available throughout the quarter to speak with all, you know, investors. Have a great day.

Operator: This concludes today's conference call. Thank you for your participation. You may now disconnect.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 982%* — a market-crushing outperformance compared to 171% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

See the stocks »

*Stock Advisor returns as of May 19, 2025

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. Parts of this article were created using Large Language Models (LLMs) based on The Motley Fool's insights and investing approach. It has been reviewed by our AI quality control systems. Since LLMs cannot (currently) own stocks, it has no positions in any of the stocks mentioned. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.