Got $1,000 to Invest? Buying This Simple ETF Could Turn It Into a More Than $40 Annual Stream of Passive Income.

Investing in the stock market can seem like a daunting task. There are so many options available. Making matters worse, there's so much uncertainty in the air these days with tariffs and their potential impact on the economy and stock market.

If you're feeling nervous about stocks and picking individual ones, one solution is to invest in a top exchange-traded fund (ETF). These investment vehicles can provide broad exposure to the market's long-term upside with less risk. A simple one to start with is the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD). It holds a portfolio of high-quality dividend stocks that can provide investors with a tangible return during uncertain times in the form of dividend income. For example, investing $1,000 into this fund would at its current payout produce about $40 of dividend income each year. That's only part of the draw, which is why it's such a great fund to buy right now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Turning cash into cash flow

The Schwab U.S. Dividend Equity ETF has a very simple strategy. It tracks an index (Dow Jones U.S. Dividend 100 Index) that screens companies based on the quality of their dividends and financial profiles. The result is a list of 100 companies with higher dividend yields, strong dividend growth rates, and healthy financial profiles.

For example, the fund's top holding is Coca-Cola (NYSE: KO). The beverage giant currently has a dividend yield of nearly 3%, which is about double the yield of the broader market (the S&P 500's dividend yield is less than 1.5%). Coca-Cola increased its dividend payment by 5.2% earlier this year. That marked the 63rd consecutive year it increased its dividend. It's part of the elite group of Dividend Kings, companies with 50 or more years of annual dividend growth. The company backs its dividend with strong free cash flow and a top-notch balance sheet.

At the fund's annual rebalancing last month, its holdings had an average dividend yield of 3.8%. That yield has crept up as the stock market (and the ETF's value) has declined in recent weeks and is now up over 4%. At that rate, a $1,000 investment in the fund would produce more than $40 of annual passive income.

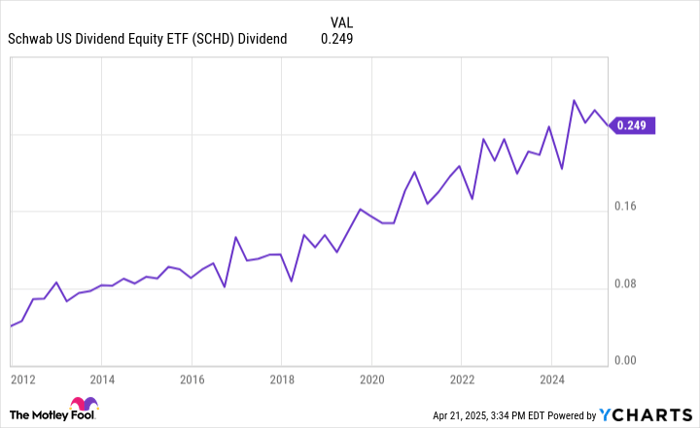

Meanwhile, the current group of holdings has delivered an average dividend growth rate of 8.4% over the past five years. Because of that, the ETF should steadily pay out more cash as its holdings continue increasing their payouts:

SCHD Dividend data by YCharts

Dividend income is only part of the draw

The likely growing stream of dividend income supplied by the Schwab U.S. Dividend Equity ETF provides investors with a solid base cash return. While the payment will ebb and flow each quarter based on when the underlying companies make their dividend payments, it should continue to steadily head higher as they grow their dividends. Given the strength of their financial profiles, these companies should continue increasing their payouts even if there's a recession.

That rising income stream is only part of the return. The share prices of the companies held by the fund should increase in the future as they grow their earnings in support of their rising dividends.

Over the long term, dividend growth stocks have historically produced excellent total returns. According to data from Hartford Funds and Ned Davis Research, dividend growers and initiators have delivered an average annual return of 10.2% over the past 50 years. That has outperformed companies with no change in their dividend policy (6.8%), non-dividend payers (4.3%), and dividend cutters and eliminators (-0.9%).

The Schwab U.S. Dividend Equity ETF has delivered similarly strong returns throughout its history. It has produced an 11.4% annualized return over the past decade and 12.9% since its inception in 2011. While there's no guarantee it will earn returns at those levels in the future, its focus on the top dividend growth stocks puts it in an excellent position to continue delivering strong returns for investors.

A great fund to buy right now

With the stock market slumping this year, shares of the Schwab U.S. Dividend Equity ETF are down about 15% from the high point earlier in the year. That's a great entry point for this high-quality fund. It positions investors to generate lots of dividend income while potentially capturing strong total returns over the long term.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $591,533!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $652,319!*

Now, it’s worth noting Stock Advisor’s total average return is 859% — a market-crushing outperformance compared to 158% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of April 21, 2025

Matt DiLallo has positions in Coca-Cola and Schwab U.S. Dividend Equity ETF. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.