Key Points

QuantumScape has figured out how to make electric vehicle batteries better than the current state of the art.

It's still not actually manufacturing these batteries at scale, and it’s not clear when it might begin doing so.

This stock’s inability to hold on to its recent gains is a red flag, but the retracement seems exaggerated.

The past few weeks have been wild ones for QuantumScape (NYSE: QS) shareholders. After it drifted to a multi-year low in April, something suddenly lit a fire under this electric vehicle (EV) technology stock in late June. Shares were up by more than 200% less than a month later.

That something was a breakthrough in how the company manufactures its high-performance EV battery packs. A key step in the process can now be completed about 25 times faster than before, offering the market some assurance that this pre-commercialization outfit will have the production capacity it needs when it needs it.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Nearly half of that gain has unsurprisingly been unwound in the meantime. Investors jumped in response to the news, but eventually remembered that there's more this start-up needs to accomplish before mass commercialization. On the other hand, this pullback could also prove to be a fantastic second chance to dive in at a decent price.

What's QuantumScape?

First things first. What the heck is QuantumScape?

This company makes lithium-based batteries like the ones the majority of modern electric vehicles require. QuantumScape's batteries are better than the standard lithium-ion battery you'll find powering most EVs these days. Not only are its solid-state lithium battery packs capable of storing more energy, they don't require the usual anode, tackling two of the EV battery business' lingering challenges. This simpler design not only translates into lower manufacturing costs, but also lower overall materials costs on a per-watt basis.

The only problem? QuantumScape's batteries aren't actually being manufactured at commercial scale yet. It's not entirely clear how much it will cost or how difficult it will be to do so, either. The only powerpacks it's made so far are prototypes provided to carmakers that want to tinker with the technology in their own electric vehicles.

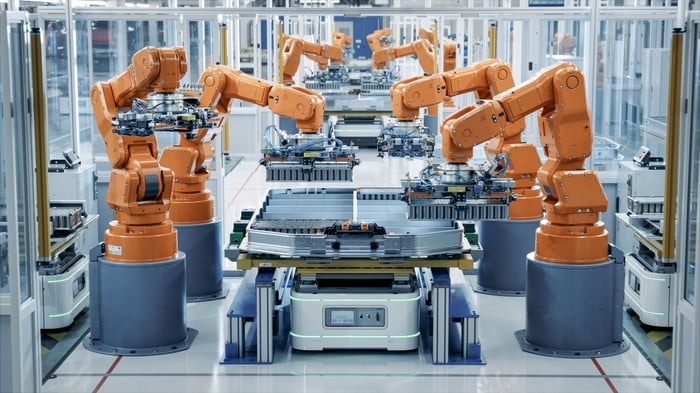

Image source: Getty Images.

Still, the science is quite promising. The solid-state batteries the company has made provide on the order of 15% to 40% more driving range than comparable conventional lithium-ion batteries do.

Perhaps more importantly, they're far more durable. QuantumScape's own testing indicates that its powerpacks are capable of holding 95% of their original charge capacity, even after 1,000 recharges. That's about 300,000 miles worth of driving, alleviating one of would-be EV owners' top cost concerns -- the eventual replacement of their electric vehicle's battery at a price tag of anywhere between $10,000 and $20,000.

A big leap forward

Given all this, the company's story is compelling. The question is: How close is QuantumScape to actually manufacturing an affordable and functional solid-state EV battery at scale? Well, it's at least one step closer to this endzone than it was a little over a month ago.

In late June, QuantumScape announced it had successfully integrated its advanced "Cobra" separator process into the production of its baseline lithium cells. That means the ceramic-based separator between its batteries' solid cathodes and the company's anode alternative can now be layered into place about 25 times faster than the company's previous fabrication process.

That's the whole reason for July's brilliant burst of bullishness. Welcome to the world of story stocks.

Still, it's easy to see why the market suddenly became so excited. This is no small matter. This ceramic material negates the need for a porous polymer separator between the liquid electrolyte and lithium metal material found inside most common lithium-based batteries. Not only is the solid nature of QuantumScape's battery materials more efficient at transferring a charge from one side of the battery to another, there's little loss of this efficiency over time, compared to a fluid material.

Liquid electrolytes are also potentially just more dangerous than their solid-state counterparts, since they're more likely to be ignited and burn out of control than solid-state batteries.

More to the point for investors, being one (admittedly big) step closer to being able produce its batteries at scale is a big win for QuantumScape, and its shareholders. Even if the bulls did end up getting ahead of themselves and have since cooled their jets, that's what catapulted the stock higher in July, reminding investors that story stocks like this one can be quite unpredictable.

Don't waste the in-the-meantime

The overarching question remains: Is QuantumScape stock a buy following its battery breakthrough?

One of the key details glossed over by the noise of the recent run-up is that this $5 billion company is still bleeding money. It spent over $500 million last year, mostly on research and development, topping 2024's and 2023's outlays. And there's not a stitch of revenue yet. That's not an unusual situation for a start-up that's still refining what could be a game-changing technology; you have to spend money to make money. But it's a concern when there's less than $1 billion worth of cash and liquid assets on the balance sheet. Fund-raising could be in the cards.

There's also no assurance that paying customers will actually step up once at-scale production becomes possible. The company's said both should materialize sometime in 2026, but such timelines are difficult to predict when a technological solution is as new as this one is. Either way, meaningful revenue wouldn't likely start to flow until 2027 or even 2028, with profits unlikely for at least a while after that.

Nevertheless, Volkswagen -- the world's second-biggest automaker, and one of its biggest EV manufacturers -- has remained interested and financially supportive for years now when it didn't have to do so. It's QuantumScape's single biggest shareholder, in fact. Given how close QuantumScape is to the finish line now, it would be surprising if Volkswagen didn't see the development of these superior EV batteries all the way through.

The only catch is that the massive automaker probably doesn't care at this point if QuantumScape ever actually turns a profit. It just wants the advanced lithium batteries. That's not the case for individual QS shareholders.

Bottom line? Buy it if you're inclined to take a big risk with a potentially big reward. Just be prepared for plenty of volatility, and the possibility of significant losses. Even for most risk-tolerant investors, the odds of any meaningful long-term upside aren't quite high enough here to justify the amount of risk you'd actually be taking on.

Sure, that could change in the future. Just don't miss out on other opportunities in the meantime while you're waiting to see if this story stock that raises more questions than it answers actually pans out. Don't sweat not getting in on the proverbial ground floor, either. If QuantumScape's tech is going to pay off, that will become clear enough once real revenue starts to flow.

Should you invest $1,000 in QuantumScape right now?

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

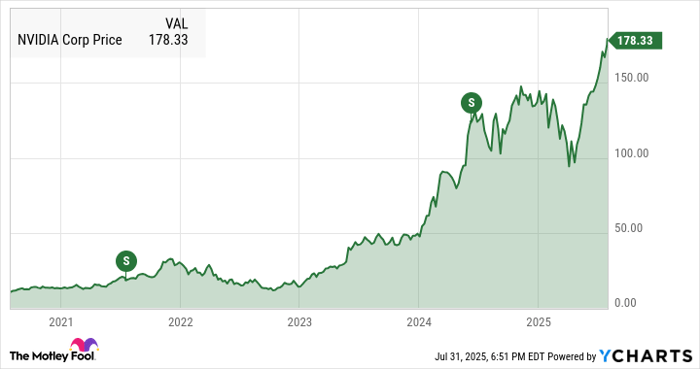

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $624,823!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,064,820!*

Now, it’s worth noting Stock Advisor’s total average return is 1,019% — a market-crushing outperformance compared to 178% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of July 29, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.