Want AI Exposure With Less Volatility? This Stock Is a Top Choice.

Key Points

IBM provides AI exposure with a 0.70 beta, offering a calmer ride than rocket ships like Nvidia or Microsoft.

Big Blue's free cash flow rose about 55% over three years despite modest revenue growth.

The stock is down in the last month and last quarter and sits well below its 52‑week high, which creates a tempting setup for new money.

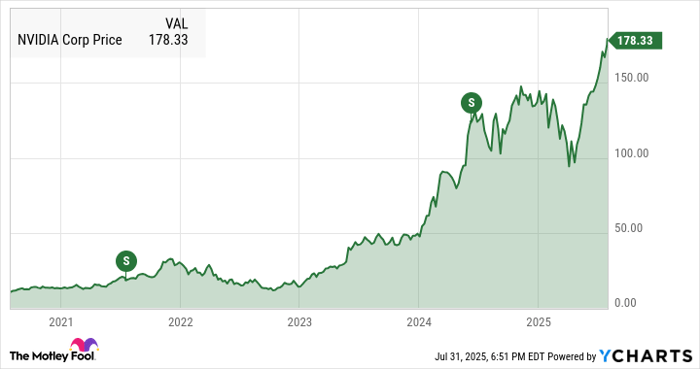

I get it. The ongoing artificial intelligence (AI) boom gives you a dopamine rush from market darlings like Nvidia and Microsoft. The recent financial results are gorgeous, the AI growth narratives are grand, and the valuation multiples are...aspirational. Microsoft stock trades at 52 times free cash flow, and Nvidia's reading on the same ratio is 58. Their price-to-sales valuations are double-digit figures.

But if you want AI exposure that won't have you checking stock futures at 3 a.m., you should consider something deeply unfashionable instead. I'm talking about IBM (NYSE: IBM).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Yes, the Big Blue IBM. The one your grandparents think still sells mainframes and punch cards. Under the hood, it's now a hybrid-cloud-and-software company with an enterprise-AI services segment that gets paid to make other people's AI actually work. Sure, IBM still sells mainframes, but even these heavy-duty data crunchers come with integrated AI systems nowadays.

In the long run, for all the romance with shiny new things and high-octane growth stories, the stock market tends to reward cash flow that shows up on time. And in the rapidly evolving AI market, IBM is a cash flow machine.

The calmer way to play AI

Let's run a few more numbers. As of Aug. 22, IBM's beta value stands at 0.70. That means IBM typically moves roughly two-thirds as much as the market, directionally.

It's a pretty calm investment. A low beta is not a bug -- it's a feature. You're trading some upside optionality for a smoother ride with fewer sudden price drops.

Valuation is the second sanity check. IBM's shares trade at 18 times free cash flow and 3.5 times trailing sales. In AI land, that's pretty austere. These modest valuation ratios suggest you're paying a fair, not fanciful, price for IBM's proven cash generation.

Meanwhile, the dividend yield is 2.8%. That's actually on the low side for IBM, whose yield averaged 4.3% over the last five years. At the same time, it's far above the S&P 500 index's average yield of 1.2% and light-years ahead of Microsoft or Nvidia -- their yields stop at 0.7% and 0.02%, respectively.

Image source: Getty Images.

Not a rocket ship, but a cash machine

"But growth!" you say. "IBM's slow-burning cash generation is boring!"

Right -- Big Blue isn't a hypergrowth story. Trailing sales are up by 7.3% over the last three years -- in total, not per year. IBM can't keep up with Microsoft's 42% revenue growth over the period, not to mention Nvidia's booming 399% top-line increase.

The counterpoint is cash profit. IBM's free cash flow surged 55% higher in this three-year period, driven by a great long-term strategy. Red Hat is the hybrid-cloud foundation on which IBM's cloud-centered AI strategy is constructed. Software subscriptions sit on top of that robust base, and consulting services glue the whole plan together. IBM lives in the boring but profitable pick-and-shovel part of the AI build-out.

WatsonX adoption is picking up the pace

IBM's customers have been testing its WatsonX AI services for a couple of years now, preparing to install enterprise-friendly AI services for the long haul. These pre-adoption tests are converting into solid long-term contracts nowadays.

You can see this trend in IBM's financial reports, and investors are taking notice. That's why the dividend yield is so low: IBM's stock has gained 22% in the last year, or 25% if you account for dividends with the total-return metric.

If you want a near-term trading angle, the ticker tape has actually done you a favor recently. IBM is down by high single digits over the past month and past quarter, nearly 19% below its 52-week high. That's not a full-on retreat, but it is a better entry point than chasing the lofty valuations of Nvidia and Microsoft.

Risks? Sure. IBM's debt leverage is substantial. And if the market decides that every AI-adjacent stock must be priced like an accelerator chip monopoly, IBM won't excite anybody.

But suppose the valuation multiples of highfliers continue to compress, as they have been doing in recent quarters. In that case, investors tend to rediscover IBM-like stocks with strong cash flows, rich dividends, and low beta values. This cash machine makes risk-weary investors feel safe, the way people rediscover umbrellas in the rain.

IBM belongs in a balanced AI portfolio

I'm not telling you to sell Nvidia or Microsoft. They are great companies with tremendous business growth, and they might even deserve their trillion-dollar valuations in the long run. I'm just suggesting solid portfolio construction over exciting narratives. Keep your rocket stocks; add a reliable ballast.

IBM gives you sticky enterprise AI exposure with a lower-volatility profile, a reasonable multiple, and generous cash returns while you wait.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 18, 2025

Anders Bylund has positions in International Business Machines and Nvidia. The Motley Fool has positions in and recommends International Business Machines, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.